Are you burdened by the true cost of your student loans? Understanding the total cost of your student loan over time is crucial for effective financial planning. Many borrowers focus solely on the initial loan amount, overlooking the significant impact of interest accrual and other fees. This article will guide you through a step-by-step process to accurately estimate the total repayment amount, enabling you to make informed decisions about your financial future and avoid the pitfalls of unexpected loan costs. We’ll break down how to calculate the total interest paid, consider the effects of different repayment plans, and help you develop strategies to manage your student loan debt effectively.

Ignoring the long-term cost of your student loan debt can lead to severe financial strain. This comprehensive guide will equip you with the knowledge and tools to calculate your total student loan cost, factoring in all relevant charges. You’ll learn to accurately predict your monthly payments, the total amount repaid, and the overall financial impact of your loan. Ultimately, understanding the true cost of your student loans is essential for effective financial planning and achieving your long-term financial goals. Mastering this calculation empowers you to make informed decisions, navigate your repayment journey confidently, and escape the burden of excessive student loan interest.

Understanding Principal, Interest, and Term Length

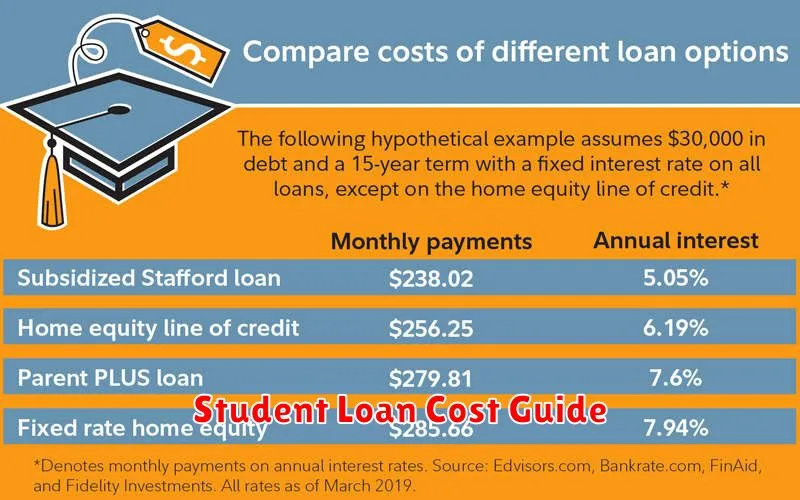

To accurately estimate the true cost of your student loan over time, understanding the relationship between principal, interest, and term length is crucial. The principal is the original amount of money borrowed. Interest is the cost of borrowing that money, expressed as a percentage (the interest rate). The term length is the period of time you have to repay the loan.

A longer term length will typically result in lower monthly payments, but you’ll end up paying significantly more in interest overall. Conversely, a shorter term length means higher monthly payments but less interest paid in the long run. The interest rate directly impacts the total interest accrued; a higher rate will increase your total repayment amount.

Consider this example: a $10,000 loan with a 5% interest rate over 10 years will cost more in total than the same loan over 5 years, even though the monthly payments will be lower in the 10-year plan. The difference represents the additional interest accrued due to the extended term length. Understanding how these three factors interact is key to making informed decisions about your student loan repayment strategy.

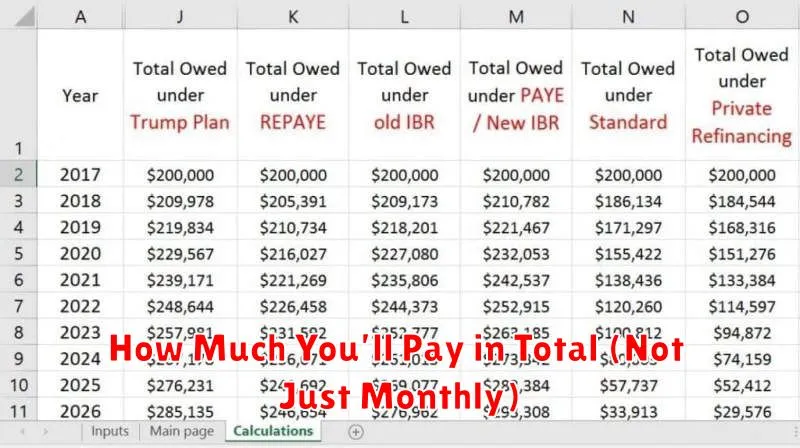

How Much You’ll Pay in Total (Not Just Monthly)

Understanding the total cost of your student loan is crucial, not just the monthly payment. This total cost encompasses the principal loan amount plus all accumulated interest over the loan’s lifespan. To calculate this, you need the following information: your loan principal (the initial amount borrowed), your annual interest rate, and your loan repayment term (length of the loan).

Several online student loan calculators can help estimate your total repayment amount. Simply input your loan details, and the calculator will project the total amount you’ll pay back, including interest, over the chosen repayment period. This total figure provides a comprehensive understanding of your overall financial commitment to student loan debt. Consider different repayment plans – standard, extended, or income-driven – as they significantly impact the total cost and monthly payments. Remember to factor in potential fees and penalties as these will add to the overall expense.

Accurate estimation of the total cost is essential for long-term financial planning. This figure clarifies the true financial burden of your student loan, enabling informed decisions about budgeting, career choices, and future financial goals. Ignoring the total cost and focusing solely on monthly payments can lead to underestimating the debt’s long-term impact.

How Deferment or Forbearance Impacts Your Cost

Deferment and forbearance, while offering temporary relief from student loan payments, significantly increase the total cost of your loan. This is because interest continues to accrue during these periods, adding to your principal balance.

In deferment, interest may or may not capitalize (be added to your principal), depending on your loan type. If it capitalizes, you’ll pay interest on the accumulated interest, leading to substantially higher payments and a greater overall cost.

Forbearance similarly accrues interest, which is usually capitalized at the end of the forbearance period. This capitalization dramatically increases the principal amount owed, resulting in higher monthly payments and a higher total repayment amount.

Therefore, while deferment and forbearance can provide short-term financial breathing room, it’s crucial to understand their long-term impact on your loan’s total cost. Explore all options carefully and consider the financial implications before choosing either option.

Effect of Missed Payments on Long-Term Cost

Missed student loan payments significantly increase the overall cost of your loan. This is due to several factors.

Firstly, you’ll accrue late fees. These fees can range from a small percentage of your missed payment to a substantial amount, depending on your lender and loan terms. The accumulation of these fees over time can add hundreds or even thousands of dollars to your total debt.

Secondly, a missed payment will negatively impact your credit score. A lower credit score can lead to higher interest rates on future loans, not just for student loans, but for mortgages, auto loans, and credit cards. This increased interest rate will further raise your long-term borrowing costs.

Thirdly, your loan may enter deferment or forbearance, temporarily suspending payments. While this provides short-term relief, interest usually continues to accrue, potentially increasing your principal balance and extending the repayment period, ultimately leading to a higher total cost.

Finally, consistent missed payments could lead to loan default. This has severe consequences, including damage to your credit, wage garnishment, and potential legal action. The cost of dealing with a defaulted loan far surpasses the original loan amount.

Therefore, making timely payments is crucial to minimizing the long-term financial burden of your student loans.

Refinancing: When It Helps and When It Doesn’t

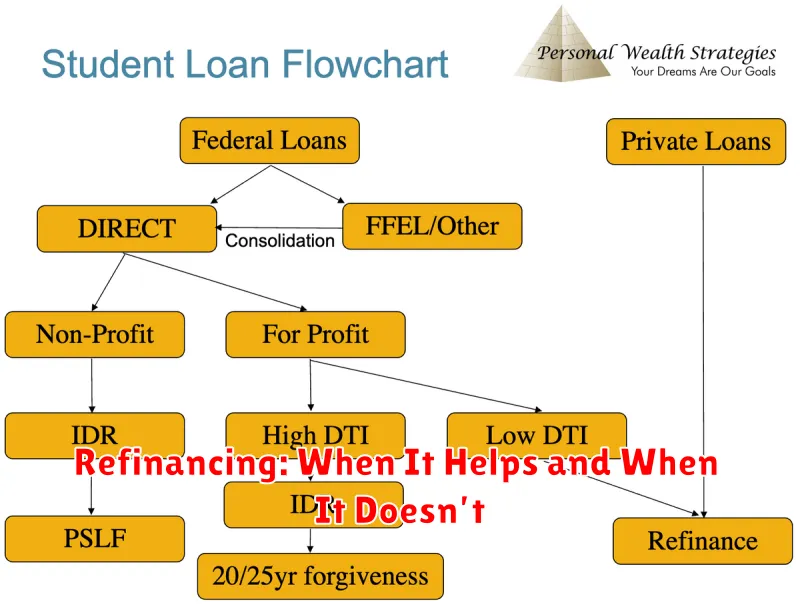

Refinancing your student loans can be a powerful tool for saving money, but it’s not always the best option. It’s crucial to carefully weigh the pros and cons before making a decision.

Refinancing helps when you can secure a significantly lower interest rate than your current loans. This leads to lower monthly payments and less interest paid over the life of the loan. It’s also beneficial if you can consolidate multiple loans with varying interest rates into a single, simpler payment.

However, refinancing doesn’t help if your credit score is low, preventing you from qualifying for a better rate. Additionally, refinancing might not be advantageous if you have federal student loans with benefits like income-driven repayment plans or loan forgiveness programs. Losing these benefits could outweigh any potential savings from a lower interest rate. Finally, consider the fees associated with refinancing; these costs can negate any potential savings.

Ultimately, the decision of whether or not to refinance should be based on a thorough evaluation of your individual financial situation and the terms of your current and potential new loans.

Use Loan Simulators for Better Planning

Accurately estimating the true cost of your student loan over time can be challenging. Loan simulators provide a valuable tool to overcome this hurdle. These online tools allow you to input key details such as your loan amount, interest rate, repayment plan, and loan deferment or forbearance periods.

By using a simulator, you can generate realistic projections of your monthly payments, total interest paid, and the total amount you will repay over the life of the loan. This detailed breakdown helps you understand the long-term financial implications of your student loan debt.

Different repayment options significantly impact the overall cost. Simulators allow you to experiment with various repayment plans (e.g., standard, extended, income-driven) to compare their effects on your monthly payments and total interest paid. This comparative analysis empowers you to make an informed decision about the best repayment strategy for your individual circumstances.

Furthermore, unexpected life events can affect repayment. Simulators can help you explore the consequences of potential delays or interruptions in your payments. This foresight allows you to develop contingency plans and better manage your finances.

In summary, using loan simulators enables proactive financial planning. By providing clear, customizable projections, simulators empower you to make well-informed decisions regarding your student loan repayment, ultimately leading to better financial management and reducing the overall cost and stress associated with your student loan debt.

How to Avoid Overborrowing From the Start

Careful planning is crucial to avoid overborrowing. Before applying for loans, meticulously research the cost of your chosen program, including tuition, fees, and living expenses.

Explore all financial aid options, such as grants, scholarships, and work-study programs, to reduce your reliance on loans. Prioritize need-based aid before considering loans.

Budget realistically for living expenses during your studies. Avoid unnecessary expenses to minimize the amount you need to borrow. Consider living at home or in affordable housing options.

Borrow only what you absolutely need. Compare loan offers carefully and choose the ones with the lowest interest rates and most favorable repayment terms. Avoid taking out more than the minimum necessary to cover your educational costs.

Regularly monitor your borrowing throughout your academic career. Stay informed about your loan balance and make sure you’re not exceeding your planned borrowing amount.