Securing a business loan can be a pivotal step in your company’s growth, providing the funding necessary to expand operations, invest in equipment, or manage cash flow. However, navigating the loan application process requires careful planning and a thorough understanding of key factors. This article outlines essential things to know before applying for a business loan, helping you increase your chances of approval and secure the best possible terms for your small business or startup. Understanding your credit score, preparing comprehensive financial statements, and researching various loan options are all critical steps in this journey.

Before submitting your business loan application, it’s crucial to assess your financial health and understand the implications of different loan types. This includes carefully examining your credit score, compiling detailed financial statements, and researching available loan options, such as SBA loans, term loans, and lines of credit. Knowing your business credit score, understanding interest rates, and being aware of potential fees and repayment schedules will empower you to make informed decisions and significantly improve your chances of obtaining the financing you need to achieve your business goals.

Types of Business Loans: Term, SBA, Lines of Credit

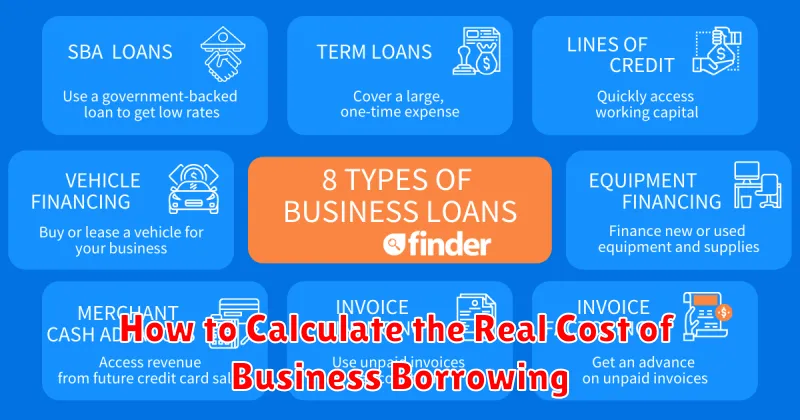

Understanding the different types of business loans is crucial before applying. Three common options include term loans, Small Business Administration (SBA) loans, and lines of credit.

Term loans provide a fixed amount of money for a specific purpose, repaid in regular installments over a predetermined period. They typically have fixed interest rates and are suitable for significant, one-time investments like equipment purchases or building renovations.

SBA loans are government-backed loans offered through participating lenders. They often have lower down payments and more favorable terms than conventional loans, but the application process can be more rigorous. These are attractive for businesses that may struggle to secure funding otherwise.

Lines of credit function like a credit card for businesses. They provide access to a predetermined amount of funds that can be borrowed and repaid multiple times, usually with a variable interest rate. This is ideal for businesses with fluctuating cash flow needs.

Choosing the right loan type depends heavily on your business’s specific needs, creditworthiness, and financial goals. Carefully consider the terms and conditions of each before making a decision.

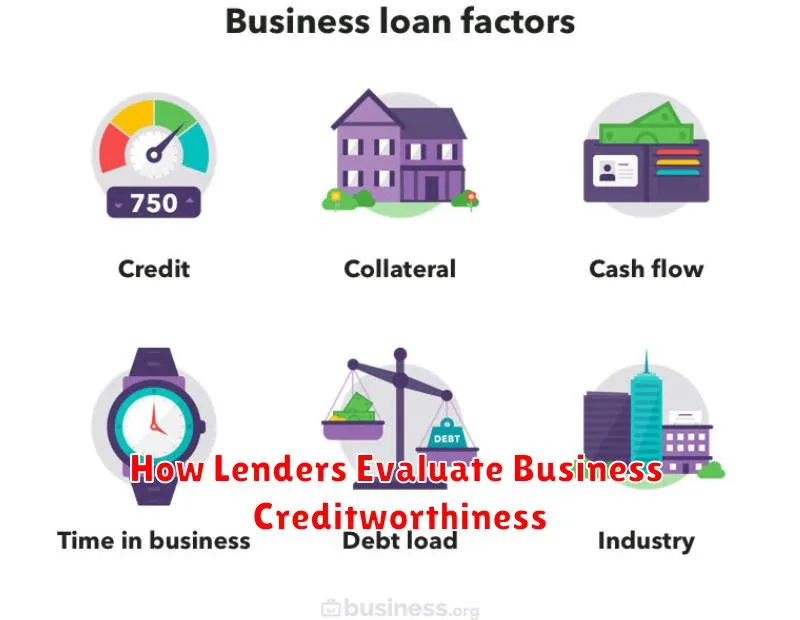

How Lenders Evaluate Business Creditworthiness

Lenders assess business creditworthiness through a rigorous evaluation of several key factors. Financial statements, including income statements, balance sheets, and cash flow statements, are crucial. These documents reveal the business’s profitability, liquidity, and overall financial health. Lenders scrutinize these figures to gauge the borrower’s ability to repay the loan.

Credit history plays a significant role. A strong credit score and history of timely payments demonstrate reliability and responsible financial management. Lenders often pull both personal and business credit reports to assess risk. Any past delinquencies or bankruptcies can negatively impact approval chances.

Beyond financials, lenders examine the business plan. A well-defined business plan outlining the company’s goals, strategies, and market analysis demonstrates foresight and a clear understanding of the business’s operations. This plan helps lenders assess the viability and potential for success of the venture.

Management experience and industry knowledge are also vital. Lenders want to see a capable and experienced team leading the business. The team’s background, expertise, and industry understanding influence the lender’s confidence in the business’s long-term prospects and ability to navigate challenges.

Finally, collateral, or assets that can be used to secure the loan, is often considered. This could include real estate, equipment, or inventory. Offering collateral reduces the lender’s risk and may improve the chances of loan approval, particularly for larger loan amounts.

What You Need in a Business Loan Application

A successful business loan application requires meticulous preparation. You’ll need to provide comprehensive financial information, demonstrating your business’s financial health and potential for repayment. This typically includes at least three years of tax returns, profit and loss statements, and balance sheets.

Beyond financials, lenders require a detailed business plan outlining your business’s goals, strategies, and market analysis. This document should clearly articulate your need for the loan and how you intend to use the funds.

Personal financial information is also crucial. Lenders assess your personal creditworthiness, often requiring your personal credit score and financial statements. This demonstrates your commitment and ability to repay the loan.

Finally, be prepared to provide collateral. This could be assets owned by your business, such as equipment or real estate, or personal assets. Collateral reduces the lender’s risk and increases your chances of approval.

The specific requirements may vary based on the lender and loan type, but having these key elements prepared significantly enhances your application’s strength and likelihood of success.

Understanding Collateral and Personal Guarantees

When applying for a business loan, lenders often require collateral or a personal guarantee to mitigate their risk. Understanding these concepts is crucial for a successful application.

Collateral refers to assets you pledge to the lender as security for the loan. If you default on the loan, the lender can seize and sell the collateral to recover their losses. Common examples include real estate, equipment, and inventory. The value of the collateral should generally equal or exceed the loan amount.

A personal guarantee is a legally binding promise where you, as the business owner, personally guarantee repayment of the loan. This means that if your business fails to repay the loan, the lender can pursue your personal assets, such as your home or savings, to recover the debt. This significantly increases the lender’s confidence in your ability to repay.

The lender’s requirement for collateral or a personal guarantee will depend on several factors, including your credit history, the loan amount, and the type of business. Carefully consider the implications of both before agreeing to either, as they can have significant financial consequences.

Common Reasons Applications Are Denied

Poor credit history is a major factor. Lenders assess your credit score and history of debt repayment. A low score significantly reduces your chances of approval.

Insufficient cash flow demonstrates an inability to repay the loan. Lenders require proof of consistent and sufficient income to cover loan repayments.

Weak business plan is often a deal-breaker. A poorly written or unrealistic business plan lacks the convincing evidence of viability and profitability needed to secure funding.

Lack of collateral increases the risk for lenders. Offering collateral, such as property or equipment, can significantly improve your chances of approval.

High debt-to-income ratio shows that your business is already heavily leveraged. A high ratio indicates a higher risk of default.

Inadequate financial statements prevent lenders from accurately assessing your financial health. Complete and accurate financial records are essential for a successful application.

Short business history can make it difficult for lenders to assess your track record. A longer operating history with stable performance increases your credibility.

Incomplete application demonstrates a lack of seriousness and preparation. Ensuring all required documents and information are submitted is crucial.

How to Calculate the Real Cost of Business Borrowing

Understanding the true cost of borrowing is crucial before securing a business loan. The interest rate quoted by lenders is only part of the picture. You need to calculate the Annual Percentage Rate (APR), which includes all fees and charges associated with the loan.

To calculate the APR, you’ll need the following information: the loan amount, the interest rate, the loan term (in years or months), and all associated fees (origination fees, application fees, closing costs, etc.). Many online calculators are available to simplify this process. Inputting these figures will provide the total cost of the loan over its lifetime, including interest and fees.

Beyond APR, consider the impact on your cash flow. Calculate your monthly payments to ensure they align with your business’s budget and projected revenue. Factor in the loan’s potential effect on your profit margins and debt-to-equity ratio. A comprehensive understanding of these financial implications is vital for making an informed decision.

Finally, remember to compare offers from multiple lenders. Interest rates and fees can vary significantly, impacting the overall cost of your borrowing. Thoroughly analyzing these factors will help you choose the most affordable and suitable loan for your business needs.

When It Makes Sense to Delay a Loan Application

Delaying a business loan application can be a strategic move under certain circumstances. Poor credit score is a major reason. Addressing credit issues before applying significantly improves your chances of approval and securing favorable terms. Similarly, if your financial projections are weak or unrealistic, delaying allows time to refine your business plan and demonstrate stronger potential for repayment.

Another crucial factor is incomplete documentation. Lenders require thorough financial records and supporting documents. A rushed application with missing information can result in rejection. Take the time to gather everything necessary for a complete and accurate submission.

Finally, consider delaying if you haven’t explored all alternative funding options. Small business grants, lines of credit, or investor funding might be more suitable or offer better terms than a traditional loan. Thorough research beforehand can save you time and potential debt in the long run.