Securing the right business loan can be the catalyst for significant growth and success. Whether you’re starting a new venture or expanding an existing one, understanding the nuances of small business loans, term loans, lines of credit, and other financing options is crucial. This article will guide you through the essential aspects of business financing, helping you navigate the complexities and make informed decisions to obtain the best possible loan terms for your specific needs. We’ll cover everything from loan eligibility requirements to interest rates and repayment schedules, empowering you to confidently approach lenders and secure the funding necessary to propel your business forward.

Understanding business loan applications, credit scores, and the various types of lenders available is paramount. This comprehensive guide will demystify the business loan process, providing valuable insights into preparing a strong application, negotiating favorable loan rates, and managing your debt effectively. Learn how to compare different loan products, understand the implications of various repayment options, and avoid common pitfalls that can hinder your chances of approval. Ultimately, we aim to equip you with the knowledge needed to make well-informed choices regarding your business funding, ensuring a smooth and successful path towards achieving your financial goals.

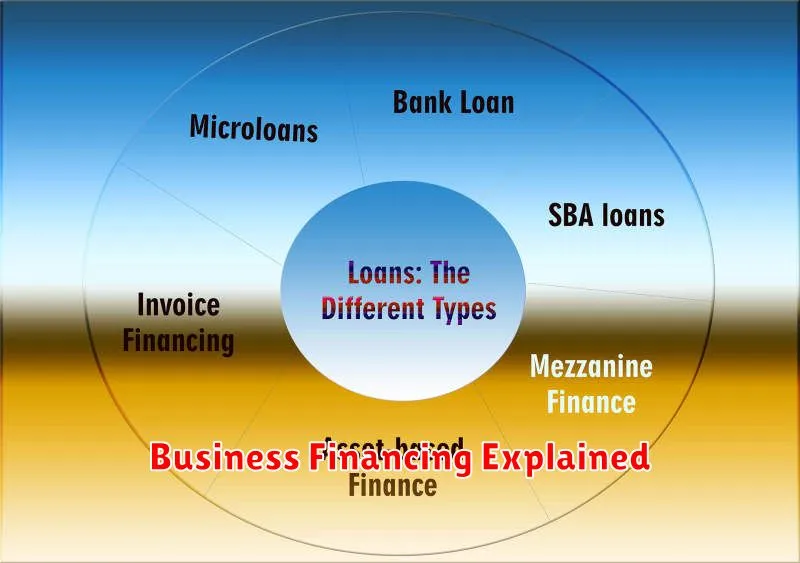

Why Businesses Take Loans (Beyond Capital)

While securing capital is a primary reason businesses take out loans, it’s not the only one. Loans offer several strategic advantages beyond simply increasing funding.

Managing cash flow is a key benefit. Loans provide a bridge during periods of low revenue or unexpected expenses, preventing disruptions to daily operations. This allows businesses to maintain a consistent payment schedule to suppliers and employees.

Strategic acquisitions and expansion are often financed through loans. These loans provide the necessary funds to purchase equipment, invest in new technologies, or acquire other businesses, significantly increasing growth potential.

Loans can also be utilized for debt consolidation, replacing multiple high-interest debts with a single, more manageable loan, ultimately reducing overall interest payments. This improves the business’s financial health and frees up cash flow for other purposes.

Finally, reputation building can be enhanced through leveraging loan financing. Securing a loan from a reputable institution can demonstrate financial stability and creditworthiness to potential investors, partners, and customers.

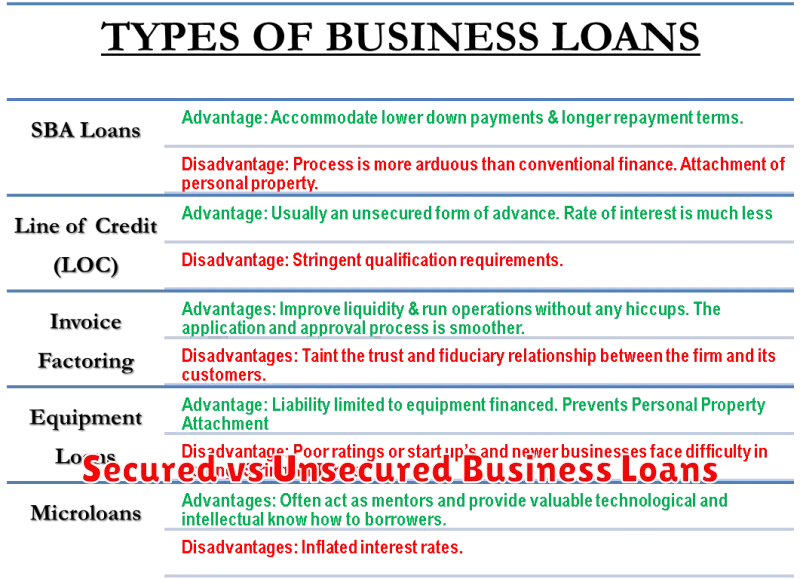

Secured vs Unsecured Business Loans

Choosing between a secured and an unsecured business loan is a crucial decision. The primary difference lies in the collateral required.

A secured loan requires you to pledge an asset, such as real estate or equipment, as collateral. If you default on the loan, the lender can seize this asset to recoup their losses. This typically results in lower interest rates and potentially higher loan amounts due to the reduced risk for the lender.

An unsecured loan, conversely, doesn’t require collateral. This makes them easier to obtain, particularly for businesses with limited assets. However, higher interest rates are common to compensate for the increased risk to the lender. The loan amounts are also generally smaller than secured loans.

The best choice depends on your business’s financial situation and risk tolerance. Consider the value of your assets, your credit history, and the amount of funding you need when making your decision. Consulting with a financial advisor can provide personalized guidance.

Common Eligibility Criteria for Business Credit

Securing a business loan often hinges on meeting specific eligibility criteria. Lenders assess various factors to determine your creditworthiness and the loan’s risk. Credit history is paramount; a strong business credit score demonstrates responsible financial management. Time in business is another key element; established businesses generally pose less risk. Revenue and profitability are crucial; lenders analyze financial statements to gauge your ability to repay the loan.

Personal credit score can also play a role, especially for smaller businesses or startups. Lenders may consider your personal finances to assess your overall financial stability. The type of business and its industry influence eligibility; some industries are considered higher risk than others. Finally, the loan amount requested and the intended use of funds are also carefully reviewed. Providing a comprehensive and well-structured business plan can significantly enhance your chances of approval.

Meeting these criteria doesn’t guarantee loan approval, but it significantly increases your prospects. Thorough preparation and a clear understanding of lender expectations are essential for a successful application. Remember to accurately present your financial information and demonstrate a viable business plan.

How Repayment Terms Affect Cash Flow

Understanding repayment terms is crucial for managing your business’s cash flow. The length of the loan term directly impacts your monthly payments. A longer term results in lower monthly payments, freeing up more immediate cash for operational expenses. However, a longer term also means paying more interest overall.

Conversely, a shorter loan term leads to higher monthly payments. This requires a stronger initial cash reserve to handle the larger outflows. But, it ultimately saves on interest expenses in the long run. The repayment schedule – whether it’s principal and interest payments, or interest-only initially – also significantly affects your monthly cash flow projections.

Choosing the right repayment terms involves carefully balancing your current cash flow with long-term financial goals. It’s essential to project your future revenue and expenses to ensure you can comfortably meet the loan obligations without hindering your business operations. Consult with a financial advisor to determine the repayment structure that best suits your specific financial situation and business needs.

Understanding Personal Guarantees and Collateral

When applying for a business loan, lenders often require personal guarantees and/or collateral to mitigate their risk. A personal guarantee is a legally binding commitment where you, as the business owner, pledge your personal assets—like your house or savings—to repay the loan if your business fails to do so. This significantly increases the lender’s confidence in your ability to repay.

Collateral, on the other hand, refers to assets you pledge as security for the loan. This could include business equipment, inventory, real estate owned by the business, or other valuable possessions. If your business defaults on the loan, the lender can seize and sell the collateral to recover their losses. The value of the collateral often influences the loan amount and interest rate offered.

Understanding the implications of both personal guarantees and collateral is crucial. A personal guarantee puts your personal finances at risk, while providing collateral can limit your business’s flexibility and potentially impact future growth opportunities. Carefully weigh the pros and cons before committing to either.

Differences Between Lines of Credit and Lump Sums

A crucial decision when seeking a business loan involves choosing between a line of credit and a lump sum. These options differ significantly in their disbursement and repayment structures.

A line of credit functions like a revolving credit card for businesses. It provides pre-approved access to funds up to a specified credit limit. You can borrow and repay funds multiple times within the credit period, paying only interest on the amount borrowed. This offers flexibility for managing fluctuating cash flow needs.

Conversely, a lump sum loan provides a single, upfront disbursement of the total loan amount. Repayment follows a predetermined schedule, typically with fixed monthly installments comprising both principal and interest. This option is suitable for one-time, significant expenditures with a clear timeline for repayment.

The best choice depends on your specific business needs. Consider the nature and timing of your expenses and your ability to manage repayments. A line of credit offers greater flexibility, while a lump sum provides a predictable repayment structure.

Loan Structures That Fit Different Business Types

The structure of a business loan significantly impacts its suitability for a particular business type. Understanding these structures is crucial for securing the best financing option.

Term loans provide a fixed amount of money over a predetermined repayment period, making them ideal for businesses with predictable cash flows needing long-term funding for expansion or equipment purchases. They’re often suitable for established businesses with a proven track record.

Lines of credit offer flexible access to funds up to a pre-approved limit. This structure benefits businesses with fluctuating cash flow needs, allowing them to borrow and repay as needed. Startups and businesses experiencing seasonal variations find this particularly useful.

Merchant cash advances are short-term loans based on future credit card sales. They are attractive to businesses with consistent credit card transactions but typically come with higher interest rates. This structure is often best suited for smaller businesses with strong sales.

Equipment financing specifically covers the purchase of equipment. The equipment itself often serves as collateral, securing the loan. This is beneficial for businesses investing in capital-intensive assets, reducing the upfront cost and spreading payments over time.

Choosing the right loan structure depends heavily on your business’s financial health, industry, stage of growth, and specific needs. Careful consideration of these factors is essential for making an informed decision.