Considering a personal loan? Understanding how they work is crucial before you apply. This comprehensive guide will equip you with the knowledge to navigate the process confidently, from understanding interest rates and loan terms to choosing the right lender and avoiding potential pitfalls. We’ll cover everything you need to know about securing a personal loan that best fits your financial needs and goals. Learn about different loan types, the application process, and the factors that influence your approval chances.

Whether you need funds for debt consolidation, home improvements, medical expenses, or unexpected emergencies, a personal loan can offer a viable solution. This guide will delve into the intricacies of repayment schedules, APR (Annual Percentage Rate) calculations, and the long-term implications of borrowing. We’ll also discuss responsible borrowing practices to ensure you manage your personal loan effectively and avoid potential financial hardship. Discover how to compare lenders, negotiate favorable terms, and make informed decisions about your personal finances.

What Is a Personal Loan and How It Differs from Other Credit

A personal loan is an unsecured loan from a bank or credit union, used for various purposes like debt consolidation, home improvements, or medical expenses. Unlike secured loans, it doesn’t require collateral, meaning your personal assets aren’t at risk if you default. The interest rate is typically fixed and the repayment period is structured with regular installments over a predetermined timeframe.

Personal loans differ significantly from other forms of credit. Unlike credit cards, which offer revolving credit, personal loans are installment loans with a set repayment schedule. Mortgages are secured loans specifically for real estate, whereas personal loans can be used for various purposes. Auto loans are similarly secured, using the vehicle as collateral, unlike unsecured personal loans. Finally, while lines of credit offer flexible borrowing, personal loans provide a lump sum upfront.

The key distinctions lie in the security (collateral), the purpose of the loan, and the repayment structure. Understanding these differences is crucial when deciding which type of credit best suits your financial needs.

Typical Uses for Personal Loans (Without Selling You One)

Personal loans offer a flexible way to finance various needs. Debt consolidation is a common use, allowing you to combine high-interest debts into a single, lower-interest payment. This simplifies repayment and potentially saves money on interest.

Home improvements are another popular application. Whether it’s a kitchen remodel or a necessary repair, a personal loan can provide the funds for significant upgrades.

Major purchases, such as a new appliance or furniture, can be financed with a personal loan, avoiding the often higher interest rates associated with store credit cards.

Medical expenses, including those not covered by insurance, can be a significant burden. A personal loan can help manage these unexpected costs.

Wedding expenses or other large events can easily be funded through personal loans, offering a structured repayment plan.

Finally, unexpected emergencies, such as car repairs or unexpected travel, can be addressed quickly with a personal loan, providing much-needed financial relief.

How Interest Rates Are Calculated

The interest rate on a personal loan is determined by several factors. Lenders consider your credit score, the loan amount, the loan term (length of repayment), and the current economic climate. A higher credit score generally results in a lower interest rate, as it indicates lower risk to the lender. Larger loan amounts and longer loan terms often correlate with higher rates due to increased risk and longer exposure for the lender.

The calculation itself typically involves a formula that determines the monthly payment. This payment covers both the principal (the original loan amount) and the interest. Many lenders use the amortization method, which distributes payments evenly over the loan term. The interest portion is higher in the early stages of the loan and gradually decreases as the principal is paid down. The specific formula is complex and varies slightly depending on the lender; however, the fundamental principles remain consistent across different institutions.

Annual Percentage Rate (APR) is a crucial aspect to understand. The APR represents the total cost of borrowing, including interest and any fees. It’s expressed as an annual percentage and allows for a more comprehensive comparison of loan offers from different lenders. Always compare the APRs of multiple loan options to secure the best terms.

While lenders use sophisticated methods, understanding the fundamental interplay between creditworthiness, loan characteristics, and market conditions will allow you to effectively evaluate interest rate offers and choose the best personal loan for your needs.

Fixed vs Variable Rates: Pros and Cons

Choosing between a fixed and variable interest rate for your personal loan is a crucial decision impacting your overall cost. Understanding the pros and cons of each is essential.

A fixed-rate loan offers predictability. Your monthly payment remains consistent throughout the loan term, simplifying budgeting. However, fixed rates might be slightly higher than variable rates initially.

Conversely, a variable-rate loan typically starts with a lower interest rate. This can lead to lower initial payments and potential savings if interest rates decline. The downside is the uncertainty; your monthly payment can fluctuate with market interest rate changes, making budgeting more challenging. If rates rise significantly, your payments could become unaffordable.

Ultimately, the best choice depends on your individual financial situation, risk tolerance, and long-term financial goals. Consider your ability to manage potential payment fluctuations before opting for a variable rate.

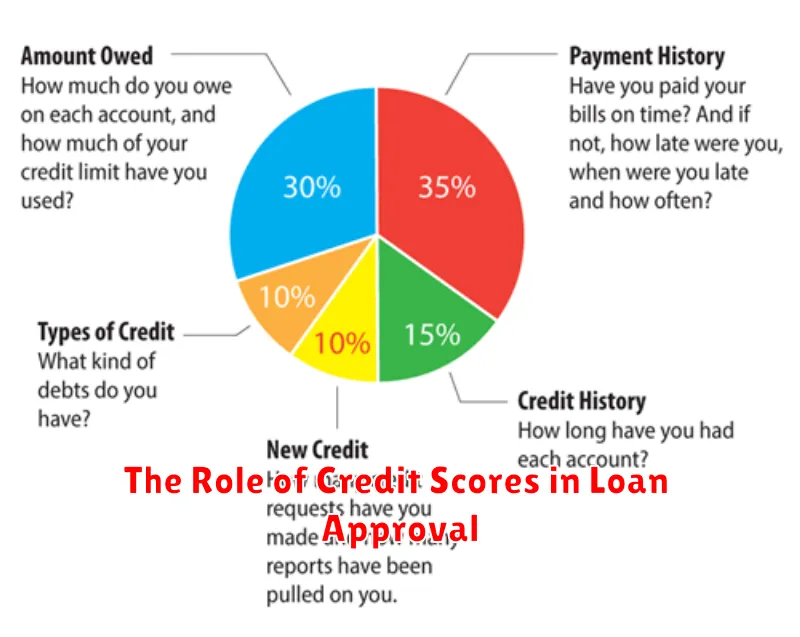

The Role of Credit Scores in Loan Approval

Your credit score is a crucial factor in determining your eligibility for a personal loan and the terms you’ll receive. Lenders use it to assess your creditworthiness, essentially measuring your ability and willingness to repay borrowed funds.

A higher credit score typically translates to better loan offers, including lower interest rates and more favorable repayment terms. This is because a strong credit history indicates a lower risk to the lender. Conversely, a lower credit score may result in loan denial or less attractive offers, such as higher interest rates and potentially higher fees.

While your credit score is a significant factor, lenders also consider other aspects of your financial situation, such as your income, debt-to-income ratio, and employment history. However, your credit score often plays the most significant role in the initial loan approval process.

Improving your credit score before applying for a loan can significantly increase your chances of approval and secure more favorable terms. This involves responsible credit management, including timely payments and keeping credit utilization low.

Repayment Terms and What to Expect

Understanding repayment terms is crucial when considering a personal loan. These terms outline the loan’s repayment schedule, typically involving fixed monthly payments over a set period (loan term).

The loan term can range from a few months to several years, influencing your monthly payment amount. A shorter term means higher monthly payments but less total interest paid, while a longer term results in lower monthly payments but higher overall interest costs.

Your monthly payment will consist of both principal (the original loan amount) and interest (the cost of borrowing). It’s important to carefully review the loan agreement to understand the annual percentage rate (APR), which reflects the total cost of borrowing, including interest and fees.

Late payment fees are common, and missing payments can negatively impact your credit score. Consider your budget and choose a repayment plan that aligns with your financial capabilities. Always prioritize making on-time payments to avoid penalties and maintain a good credit history.

Before agreeing to a loan, thoroughly understand the repayment terms, including the loan term, monthly payment amount, APR, and any associated fees. Don’t hesitate to ask questions to ensure you fully grasp the financial obligations involved.

Common Mistakes to Avoid When Taking a Loan

Taking out a personal loan can be beneficial, but avoiding common mistakes is crucial for a positive experience. One major error is not shopping around for the best interest rates and terms. Different lenders offer varying rates, so comparing offers is essential to securing the most favorable loan.

Another frequent mistake is underestimating the total cost. Borrowers often focus solely on the monthly payment, neglecting fees, interest accumulation, and the overall repayment amount. Carefully reviewing the loan agreement and calculating the total cost is vital.

Ignoring your debt-to-income ratio is another pitfall. Taking on more debt than you can comfortably manage can lead to financial distress. Assess your current financial situation and ensure the loan payment fits within your budget without straining your finances.

Finally, failing to read the fine print is a common oversight. Loan agreements contain crucial details regarding interest rates, fees, and repayment terms. Thoroughly understanding all terms and conditions before signing is crucial to avoid unexpected costs or penalties.