Securing a home loan is a significant financial undertaking, and understanding the factors that influence your interest rate is crucial for securing the best possible terms. Your interest rate directly impacts your monthly payments and the overall cost of your mortgage, making it a key element in the home-buying process. This article will delve into the various elements that lenders consider when determining your home loan interest rate, empowering you to navigate this process with confidence and secure a favorable rate.

Several key factors contribute to the interest rate you’ll receive on your home loan. These include your credit score, the loan type you choose (e.g., fixed-rate, adjustable-rate), the loan-to-value ratio (LTV), and prevailing market interest rates. Understanding the weight each of these factors carries will allow you to proactively improve your chances of obtaining a lower interest rate and a more affordable mortgage. We will explore each of these influential factors in detail, providing practical strategies to optimize your position and achieve the most favorable home loan terms possible.

Credit Score and Its Direct Effect on Mortgage Rates

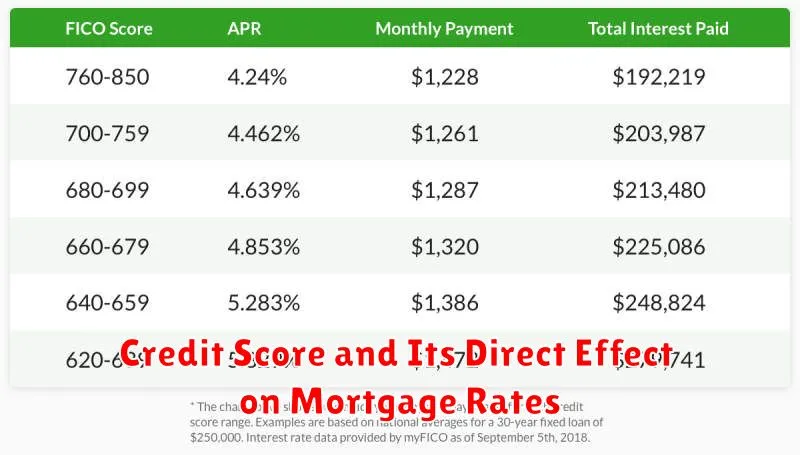

Your credit score is a crucial factor determining your mortgage interest rate. Lenders use it to assess your creditworthiness and risk. A higher credit score indicates a lower risk to the lender, resulting in a more favorable interest rate.

Credit scores range from 300 to 850, with higher scores signifying better credit history. Borrowers with excellent credit scores (typically 760 or higher) generally qualify for the lowest interest rates. Conversely, those with poor credit scores (below 660) face significantly higher rates or may even be denied a mortgage altogether.

The impact of your credit score on your mortgage rate can be substantial. Even a small difference in your score can translate into thousands of dollars in interest paid over the life of the loan. Therefore, improving your credit score before applying for a mortgage is a wise strategy to secure a more affordable loan.

Economic Factors That Lenders Consider

Several key economic factors significantly influence the interest rates lenders offer on home loans. Inflation is a major driver; high inflation generally leads to higher interest rates as lenders adjust to protect their returns against the eroding value of money. The Federal Reserve’s monetary policy plays a crucial role; interest rate hikes by the Fed directly impact borrowing costs across the board, including mortgages.

The overall economic growth rate also plays a part. Strong economic growth can lead to increased demand for loans, potentially pushing interest rates higher. Conversely, slower growth might lead to lower rates as lenders compete for borrowers. The unemployment rate is another significant factor; higher unemployment increases the risk of loan defaults, leading lenders to raise interest rates to compensate for this increased risk.

Finally, investor sentiment and market conditions within the broader bond market can also influence mortgage rates. Changes in investor confidence and the yield on government bonds often affect the pricing of mortgages, as they represent alternative investment options.

Down Payment Amount and Loan Terms

The size of your down payment significantly impacts your interest rate. A larger down payment (typically 20% or more of the home’s price) often qualifies you for a lower interest rate because it reduces the lender’s risk. A smaller down payment might necessitate private mortgage insurance (PMI), increasing your overall costs and potentially leading to a higher interest rate.

Loan terms, specifically the length of your mortgage (e.g., 15-year versus 30-year), also affect your interest rate. Shorter-term loans generally come with lower interest rates but require higher monthly payments. Longer-term loans have lower monthly payments but typically result in higher interest rates due to the extended repayment period and increased risk for the lender.

Beyond the down payment amount and loan term, your credit score, debt-to-income ratio, and the type of loan you choose all play crucial roles in determining your final interest rate. It’s advisable to shop around and compare rates from multiple lenders to find the most favorable terms for your specific financial situation.

Fixed vs Adjustable-Rate Mortgages Explained

A fixed-rate mortgage (FRM) offers a consistent interest rate throughout the loan term. This predictability makes budgeting easier, as your monthly payment remains the same. However, if interest rates fall significantly after you secure your loan, you’ll miss out on potential savings.

An adjustable-rate mortgage (ARM), conversely, features an interest rate that fluctuates based on an underlying index, typically adjusted periodically (e.g., annually). ARMs often start with a lower interest rate than FRMs, making them attractive initially. However, your monthly payments can increase substantially if the index rate rises, leading to potential financial strain. The initial lower rate is usually tied to an introductory period, after which the rate adjusts.

The choice between a FRM and ARM depends largely on your risk tolerance and financial outlook. A FRM offers stability and predictability, while an ARM provides potential for lower initial payments but carries the risk of increased payments later.

Loan-to-Value Ratio and Its Impact

Your loan-to-value ratio (LTV) significantly influences your home loan interest rate. This ratio compares the amount you’re borrowing to the appraised value of the property. A lower LTV indicates a smaller loan relative to the property’s worth, representing less risk to the lender.

Lower LTVs generally result in lower interest rates. Lenders perceive less risk of default when borrowers have more equity in their homes. Conversely, a higher LTV (meaning a larger loan amount relative to the property value) indicates higher risk, leading to higher interest rates or the requirement for private mortgage insurance (PMI).

For example, a 90% LTV (borrowing 90% of the home’s value) typically commands a higher rate than a 70% LTV. Understanding your LTV and its impact is crucial in securing the most favorable interest rate possible.

Timing the Market: Pros and Cons

Attempting to time the market when securing a home loan involves predicting future interest rate movements to obtain the lowest possible rate. This strategy carries significant risks and rewards.

Pros: Successfully timing the market can lead to substantial savings over the life of the loan. Securing a lower rate during a period of low interest rates can significantly reduce the total interest paid.

Cons: Predicting interest rate fluctuations is inherently difficult. Incorrectly timing the market can result in paying a higher interest rate than anticipated, leading to increased borrowing costs. The opportunity cost of waiting for a lower rate might involve delaying a home purchase, potentially missing out on desired properties or facing rising home prices.

Ultimately, the decision to time the market is highly personal and depends on individual risk tolerance and financial circumstances. Expert advice from a mortgage professional is crucial in navigating this complex decision.

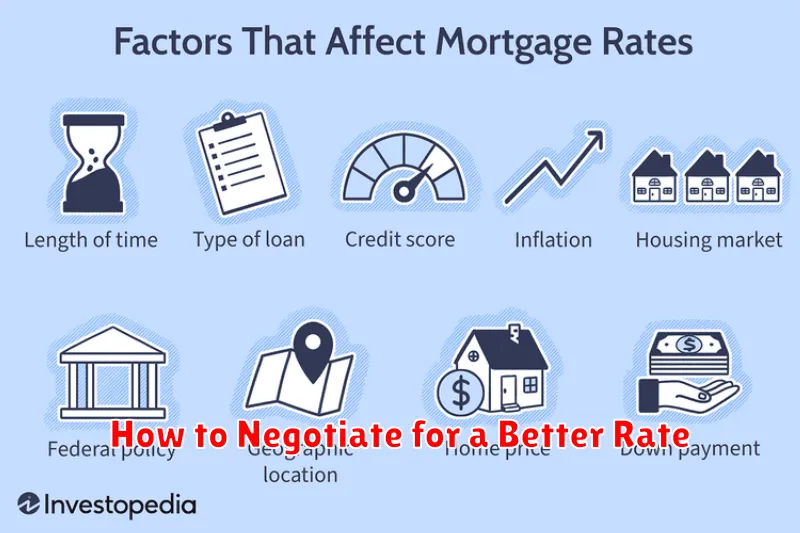

How to Negotiate for a Better Rate

Negotiating a lower interest rate on your home loan requires preparation and a proactive approach. Start by shopping around and obtaining multiple rate quotes from different lenders. This gives you leverage to compare offers and identify the best potential deal.

Next, highlight your strengths. A strong credit score, a substantial down payment, and a stable financial history are all advantageous. Emphasize these positive aspects to the lender. Consider providing documentation to support your claims.

Be prepared to negotiate. Don’t be afraid to politely push back on the initial rate offered. If another lender has offered a more favorable rate, mention this respectfully to encourage the current lender to improve their offer. Be firm but courteous throughout the process.

Finally, consider all the fees. A slightly lower interest rate might be negated by higher closing costs or other fees. Carefully compare the total cost of the loan, including all associated charges, to determine the most economical option.