Understanding how personal loans impact your long-term financial health is crucial for responsible borrowing. This article explores the multifaceted effects of personal loans, examining both the potential benefits and drawbacks on your overall financial well-being. We’ll delve into how factors like interest rates, loan terms, and credit score influence your financial future, offering insights to help you make informed decisions about securing and managing personal debt.

From consolidating high-interest debt to financing major purchases, personal loans can serve various purposes. However, improper management can lead to a cycle of debt, negatively affecting your creditworthiness and hindering your ability to achieve long-term financial goals such as buying a home, saving for retirement, or investing in your future. This comprehensive guide will equip you with the knowledge necessary to navigate the complexities of personal loan financing and make choices that promote your financial wellness.

Understanding the Impact on Credit Scores

Taking out a personal loan can significantly impact your credit score, both positively and negatively. Responsible repayment consistently demonstrates creditworthiness, leading to a higher score. This positive impact is further enhanced by the increased credit utilization ratio, provided you maintain a low balance across your credit accounts.

Conversely, missed or late payments can severely damage your credit score. These negative marks remain on your credit report for several years, making it harder to secure loans or credit cards in the future with favorable terms. Furthermore, repeatedly applying for loans in a short period can also negatively affect your score as it suggests higher credit risk to lenders.

The overall effect on your credit score depends on your credit history, payment behavior, and the loan’s terms. Careful planning and responsible borrowing are crucial to mitigating potential negative impacts and maximizing the potential benefits of a personal loan on your credit profile.

Managing Multiple Loan Repayments Responsibly

Juggling multiple loan repayments can be challenging, but responsible management is crucial for your long-term financial well-being. Prioritize high-interest loans first to minimize overall interest paid. Create a detailed budget that accurately reflects your income and expenses, ensuring sufficient funds for all loan payments.

Consider using a debt management tool or spreadsheet to track payments and due dates effectively. Explore options like debt consolidation to simplify repayment by combining multiple loans into a single, potentially lower-interest loan. This can streamline payments and improve your financial overview.

Communicate proactively with your lenders if you anticipate difficulty meeting payments. Many lenders offer forbearance or repayment plans that can provide temporary relief. Failing to communicate can negatively impact your credit score and lead to further financial complications. Maintaining open communication is key to avoiding defaults and managing your debt responsibly.

Remember, responsible management of multiple loans requires discipline and planning. By proactively addressing your debt and prioritizing payments, you can significantly improve your financial health and build a stronger financial future.

Why Missed Payments Matter More Than You Think

Missed payments on personal loans have far-reaching consequences that extend beyond immediate financial hardship. Credit score damage is the most immediate impact. A single missed payment can significantly lower your credit score, making it harder to secure future loans, mortgages, or even rent an apartment, all at potentially higher interest rates.

Furthermore, missed payments trigger late fees and penalties, adding substantially to your debt burden. These fees can quickly accumulate, making it even more challenging to repay the loan. This can create a vicious cycle of debt that is difficult to escape.

Beyond the financial ramifications, missed payments can impact your overall financial well-being. The stress associated with managing delinquent debt can negatively affect your mental and physical health. It can also damage your relationships with lenders and potentially lead to collection agency involvement, further complicating your financial situation.

In summary, while the immediate impact of a missed payment might seem manageable, the long-term consequences on your creditworthiness, financial stability, and overall well-being are substantial. Diligent repayment is crucial for protecting your long-term financial health.

How Debt-to-Income Ratio Shapes Your Future Borrowing

Your debt-to-income ratio (DTI), calculated by dividing your monthly debt payments by your gross monthly income, is a crucial factor lenders consider when assessing your loan application. A lower DTI indicates you have more disposable income relative to your debt obligations, making you a less risky borrower.

Lenders use your DTI to gauge your ability to manage additional debt. A high DTI suggests you’re already stretched financially, increasing the likelihood of default. This often results in loan rejection or less favorable terms, such as higher interest rates.

Improving your DTI before applying for a loan can significantly improve your chances of approval. Strategies include paying down existing debts, increasing your income, or applying for a smaller loan amount. Even a small improvement in your DTI can make a difference in securing better loan offers.

In short, your DTI is a powerful indicator of your creditworthiness. Managing your DTI effectively is paramount for securing future borrowing opportunities and obtaining favorable loan terms.

Steps to Minimize Loan-Related Stress

Taking out a personal loan can be a significant financial decision, and managing the associated stress is crucial for your overall well-being. Careful planning and proactive strategies are key to mitigating this stress.

First, create a realistic budget that incorporates your loan repayment. This involves tracking your income and expenses to identify areas where you can save and allocate funds for your loan payments. Avoid overspending, as this can exacerbate financial strain and increase stress levels.

Next, prioritize loan repayment. Explore different repayment options with your lender, such as accelerated repayment plans, to reduce the loan’s overall term and interest paid. Consistent, timely payments not only save money but also reduce the psychological burden of looming debt.

Furthermore, maintain open communication with your lender. If you anticipate difficulties making payments, contact them immediately. They may be able to offer solutions, such as temporary payment deferrals or modified payment plans. Proactive communication can prevent late payments and associated penalties, easing financial anxiety.

Finally, seek professional guidance if needed. A financial advisor can help you create a comprehensive financial plan, including debt management strategies. Professional advice can provide valuable insights and support to navigate the complexities of loan repayment and minimize stress.

When Refinancing a Personal Loan Makes Sense

Refinancing a personal loan can be a smart financial move, but only under specific circumstances. It primarily makes sense when you can secure a loan with a significantly lower interest rate than your current loan. This will reduce your monthly payments and ultimately save you money over the life of the loan.

Another scenario where refinancing is beneficial is when you want to consolidate multiple debts into a single, more manageable payment. This simplifies your finances and can improve your credit score if managed responsibly. However, be aware that extending the loan term to lower monthly payments may end up costing you more in overall interest.

Before refinancing, carefully compare interest rates and loan terms from multiple lenders. Consider the total cost of the loan, including fees and interest, to ensure it’s truly a better deal than your current loan. A slightly lower interest rate might not offset significant fees.

Ultimately, refinancing should be a strategic decision aimed at improving your long-term financial health. It’s not a solution for poor financial habits; responsible borrowing and repayment remain crucial.

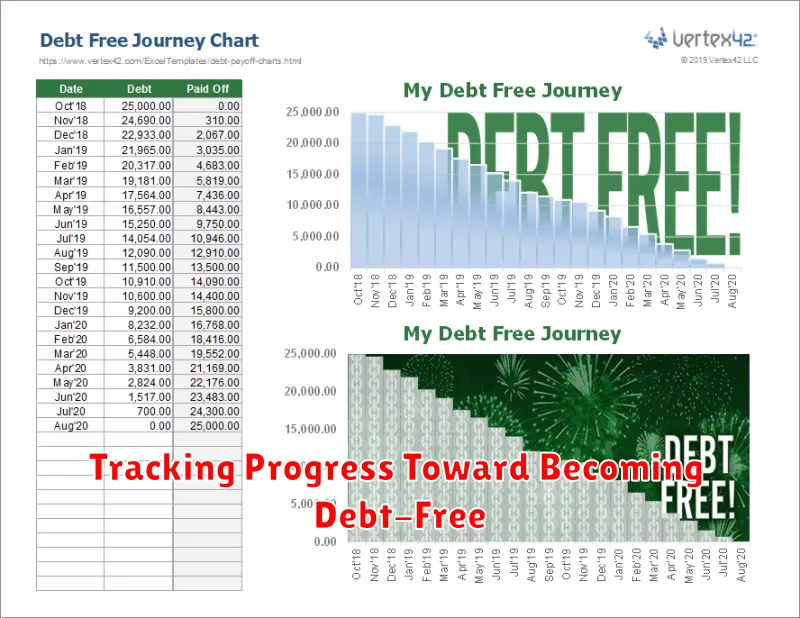

Tracking Progress Toward Becoming Debt-Free

Tracking your progress toward debt freedom is crucial when managing personal loans. Regular monitoring allows you to stay motivated and identify potential issues early on. Several methods can be used; a simple spreadsheet, a debt tracker app, or even a notebook can effectively track your debt balance, payments made, and the remaining amount.

Visualizing your progress is incredibly motivating. Consider creating a chart or graph illustrating the decrease in your debt over time. This visual representation can highlight your achievements and encourage you to stay committed to your debt repayment plan. The key is consistency: regularly update your tracking method to maintain an accurate picture of your financial situation.

Beyond simply recording numbers, actively reviewing your progress against your goals helps you stay on track. This might involve comparing your actual payments against your projected timeline or adjusting your budget if necessary. This proactive approach ensures you don’t lose sight of your financial objectives and effectively manage your debt repayment journey.

By consistently tracking and reviewing your progress, you’ll gain a clearer understanding of your financial health. This provides valuable insights to inform future financial decisions and contributes significantly to achieving long-term financial well-being.