Buying a home is often the biggest financial decision of a person’s life, and understanding all associated costs is crucial for a smooth and successful transaction. Beyond the down payment and monthly mortgage payments, there are numerous hidden home loan costs that can significantly impact your budget. This article will delve into the intricacies of escrow, a frequently misunderstood aspect of homeownership, as well as other often-overlooked expenses, empowering you to make informed financial decisions before you sign on the dotted line. We’ll uncover the truth behind these hidden fees and provide practical strategies to navigate them effectively.

From closing costs to private mortgage insurance (PMI) and homeowner’s insurance, many expenses are bundled into the overall home-buying process. Failing to account for these additional costs can lead to financial strain and unforeseen challenges. This comprehensive guide will explore the various components of escrow accounts, explaining how they function and what they cover, enabling you to accurately budget for and manage your home loan effectively. Discover how to avoid surprises and gain a clear understanding of your total cost of homeownership.

What Is Escrow and Why It’s Required

Escrow is a process where a third-party neutral holds funds or documents on behalf of two parties involved in a transaction until specific conditions are met. In the context of a home loan, this typically means your lender collects funds for your property taxes and homeowner’s insurance premiums.

Lenders require escrow to ensure that these essential payments are made promptly and consistently. Failure to pay property taxes or homeowner’s insurance could lead to foreclosure, jeopardizing the lender’s investment. By holding these funds in escrow, the lender safeguards their interest and prevents potential financial losses associated with unpaid property expenses. The escrow account is managed by your lender, who pays the relevant parties on your behalf. This ensures your mortgage payments are always current and covers all your housing expenses.

Essentially, escrow protects both the borrower and the lender. The borrower is protected from the risk of forgetting to pay these important taxes and insurance, while the lender is protected from financial risks associated with delinquent payments.

How Property Taxes and Insurance Affect Monthly Payments

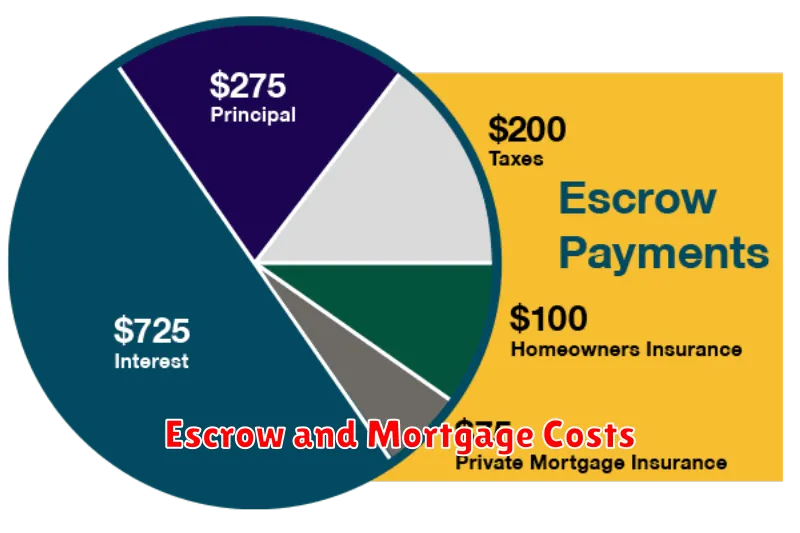

A significant portion of your monthly mortgage payment goes towards escrow. Escrow is a process where your lender collects property taxes and homeowner’s insurance premiums and holds them in a separate account until they are due.

Your property taxes are determined by your local government based on the assessed value of your home. These funds support essential local services like schools and public safety. The amount you pay annually is divided into twelve equal monthly payments added to your escrow.

Homeowner’s insurance protects you against financial losses from events such as fire, theft, or liability. Your lender requires this insurance to protect their investment in your property. Like property taxes, the annual premium is typically divided into twelve monthly payments for your escrow.

Therefore, your monthly mortgage payment includes not only the principal and interest on your loan but also a significant portion dedicated to property taxes and homeowner’s insurance, which are often hidden costs not immediately apparent in the advertised interest rate.

PMI (Private Mortgage Insurance) Explained

Private Mortgage Insurance (PMI) is an insurance policy that protects lenders from losses if a borrower defaults on their mortgage loan. It’s typically required when a borrower makes a down payment of less than 20% of the home’s purchase price.

PMI functions as a safety net for the lender. If the borrower fails to make their mortgage payments, the PMI compensates the lender for the outstanding balance. This mitigates the lender’s risk of significant financial loss.

The cost of PMI is added to the borrower’s monthly mortgage payment. The premium amount is typically calculated as a percentage of the loan amount and varies depending on several factors, including credit score and loan-to-value ratio (LTV).

Borrowers can typically cancel PMI once they achieve at least 20% equity in their home, usually through paying down the principal balance. This can be verified through an appraisal or by providing proof of equity in their home. Requirements for cancellation vary depending on the lender and the specific loan terms.

While PMI protects lenders, it represents an additional expense for borrowers. It’s crucial for potential homebuyers to factor this cost into their overall budget and to understand the conditions under which it can be removed.

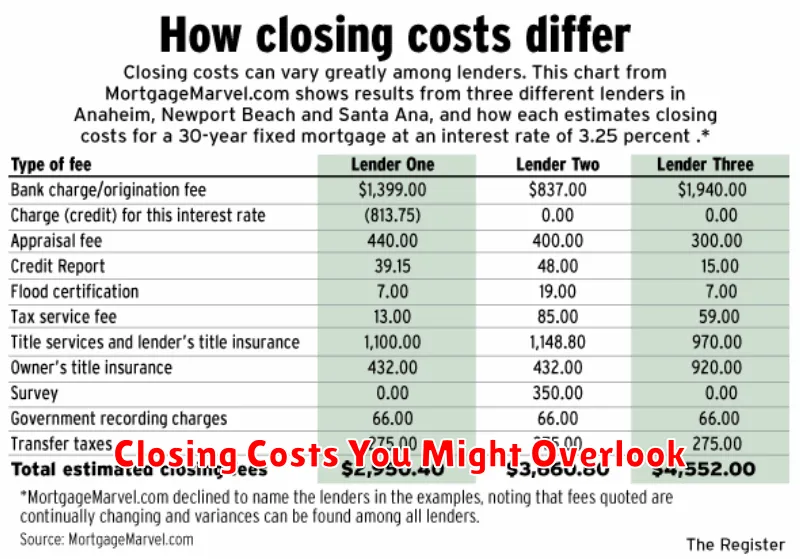

Closing Costs You Might Overlook

While many homebuyers are aware of the upfront costs associated with a mortgage, several less obvious fees can significantly impact your budget. Escrow fees, often overlooked, cover the lender’s costs for handling property taxes and homeowners insurance payments. These fees can vary, so obtaining a detailed breakdown from your lender is crucial.

Another easily missed expense is the homeowners association (HOA) fee. If your new home is part of an HOA, these fees cover maintenance and amenities. It’s important to factor this ongoing monthly expense into your budget.

Appraisal fees are essential to determine the property’s value, ensuring the lender’s risk is mitigated. While seemingly straightforward, remember to budget for this expense as it’s not always included in initial estimates.

Finally, title insurance, although vital to protect your ownership rights, is often underestimated. It is crucial to understand the cost of both the lender’s and owner’s title insurance policies.

Careful consideration of these often-overlooked closing costs ensures a smoother transition into homeownership. Thoroughly reviewing your closing disclosure and asking clarifying questions with your lender is highly recommended.

When and How Escrow Adjustments Happen

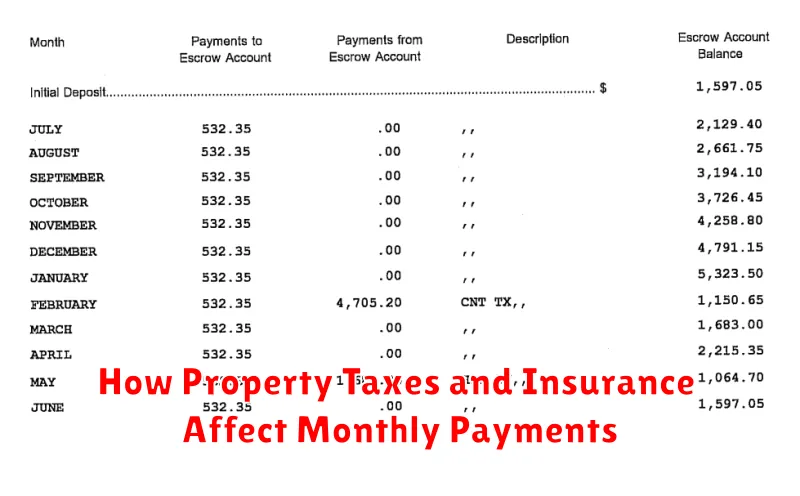

Escrow adjustments occur at closing and periodically throughout your mortgage. At closing, the lender calculates the amount needed for property taxes and homeowner’s insurance for the next year and establishes an escrow account.

Your monthly mortgage payment includes a portion to cover these costs. Throughout the year, as taxes and insurance bills are paid from your escrow account, the lender will periodically assess your account balance. If your payment has been insufficient, you’ll receive a shortfall notice, requiring an additional payment to replenish the account. Conversely, if your payments exceed the required amount, you may receive a refund or credit.

Annual adjustments are common, typically involving a review of your property tax assessment and insurance premium. This may necessitate an increase or decrease in your monthly escrow payment to reflect any changes in these costs. The lender will send a notice explaining the adjustment. These adjustments ensure your escrow account maintains sufficient funds to pay these expenses promptly.

Planning for Escrow Shortages and Overages

Escrow accounts hold funds for your property taxes and homeowner’s insurance. Careful planning is crucial to avoid shortages or overages.

Shortages occur when the escrow account lacks sufficient funds to cover payments. This results in lender advances, leading to increased loan balances and potentially impacting your credit score. To prevent shortages, regularly review your escrow analysis statement and ensure adequate funds are available. Consider increasing your monthly escrow payment if necessary.

Overages happen when the escrow account accumulates more funds than needed. While seemingly beneficial, large overages can tie up significant capital. You can request a refund from your lender for the excess funds, but be aware of any potential fees associated with this process. Regularly monitor your account balance and communicate with your lender to manage potential overages.

Proactive communication with your lender is key to successful escrow management. Understanding your payment schedule and reviewing your escrow analysis statement will enable you to proactively address both potential shortages and overages, preventing unexpected financial burdens.

How to Request an Escrow Review

To request an escrow review, you should first contact your mortgage servicer. This is typically the company that sends you your monthly mortgage statement.

You can usually initiate a review by calling their customer service number or logging into your online account. Look for options related to escrow analysis, review, or account inquiry. Some servicers also provide a dedicated form or online portal for escrow reviews.

During the request, be prepared to provide identifying information, such as your loan number and account details. Be clear and concise about your reason for requesting the review; for example, you suspect an overpayment or want to adjust your annual escrow payments.

Your servicer will then conduct a review of your escrow account. This usually involves examining your property tax and insurance payments. The servicer will inform you of the results of their review, which may include adjustments to your monthly payments.

If you are unsatisfied with the results, or if the servicer does not respond appropriately within a reasonable timeframe, consider contacting your state’s attorney general’s office or a consumer protection agency for assistance.