Embarking on the journey of student loan repayment can feel daunting, but understanding what to expect is the first step towards successful debt management. This comprehensive guide navigates the complexities of student loan repayment plans, providing insights into various repayment options, interest accrual, and strategies for minimizing your student loan debt. We’ll explore crucial aspects like income-driven repayment, loan forgiveness programs, and the potential impact on your credit score, empowering you to make informed decisions and navigate this significant financial chapter with confidence.

From understanding your loan servicer and available repayment options to developing a personalized budget and exploring debt consolidation strategies, we’ll equip you with the knowledge and tools needed to effectively manage your student loan debt. We will cover common challenges faced by borrowers, providing practical advice on avoiding default and securing your financial future. This guide will provide a clear path towards student loan repayment success, allowing you to focus on your career goals and achieve long-term financial stability.

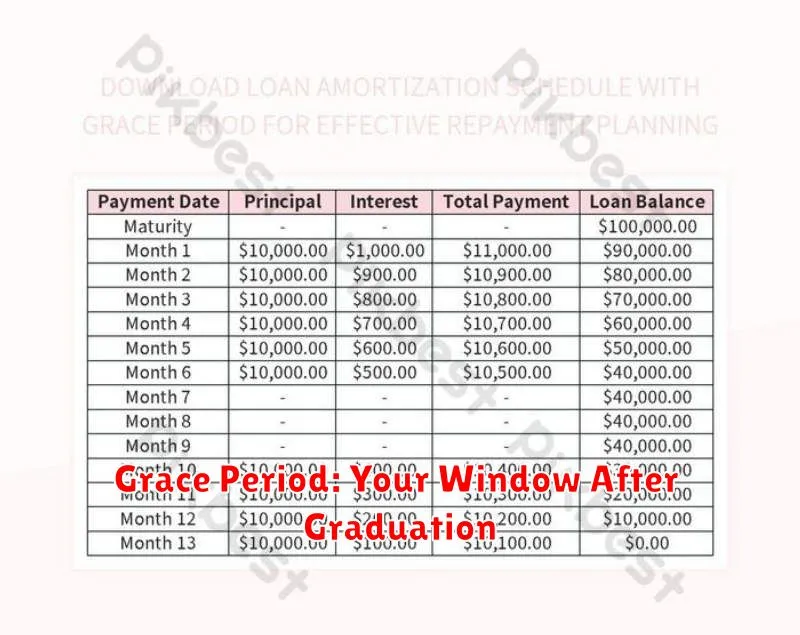

Grace Period: Your Window After Graduation

After graduating, you’re likely facing a significant life change, and the responsibility of student loan repayment may feel overwhelming. Fortunately, most federal student loans offer a grace period before repayment begins. This is a crucial period providing a buffer to help you transition into your post-graduation life.

The standard grace period for federal student loans is typically six months after graduation, leaving school, or dropping below half-time enrollment. During this time, you are not required to make payments. However, interest may still accrue on some loan types (subsidized vs. unsubsidized), impacting your total loan balance.

It’s essential to understand your specific loan terms and grace period length. This information can be found on your loan documents or through your loan servicer. Using this grace period wisely allows for planning and preparation for repayment, minimizing financial stress later on.

Consider using the grace period to secure employment, create a budget, and explore repayment options. Proactively managing your finances during this time can significantly impact your ability to successfully repay your student loans.

Types of Repayment Plans and Choosing the Right One

Understanding your options is crucial for effective student loan repayment. Several plans exist, each with varying terms and implications.

Standard Repayment is the most basic plan, offering a fixed monthly payment over 10 years. It’s straightforward but may result in higher total interest paid.

Graduated Repayment starts with lower monthly payments that gradually increase over time. This can ease the initial burden but leads to higher payments later on.

Extended Repayment stretches payments over a longer period (up to 25 years), reducing monthly payments but increasing overall interest paid.

Income-Driven Repayment (IDR) Plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), tie monthly payments to your income and family size. These plans generally result in lower monthly payments but potentially higher total interest and longer repayment periods. Eligibility requirements vary.

Choosing the right plan depends on your individual circumstances. Consider your income, financial goals, and risk tolerance. A financial advisor can help you assess your situation and recommend the most suitable option. Explore the Federal Student Aid website for detailed information on each plan and its eligibility criteria.

How to Lower Payments Without Risking Penalties

Lowering your student loan payments without incurring penalties requires careful planning and understanding of your loan terms. Income-driven repayment (IDR) plans are a primary option. These plans base your monthly payment on your income and family size, potentially resulting in lower payments than a standard repayment plan. However, it’s crucial to understand that IDR plans often extend your repayment period, leading to higher total interest paid over the life of the loan.

Another approach involves exploring deferment or forbearance. Deferment postpones payments temporarily, often requiring a qualifying hardship. Forbearance also pauses payments, but typically doesn’t require demonstrating hardship. It’s vital to note that both deferment and forbearance can negatively impact your credit score and may accrue interest, ultimately increasing your total loan cost. Therefore, it’s crucial to utilize these options strategically and only when absolutely necessary.

Careful budgeting and exploring options for increased income are also crucial steps to effectively manage your student loan payments without risking penalties. Creating a realistic budget allows you to identify areas where you can save money, freeing up funds for loan repayment. Actively seeking opportunities for professional development and salary increases can also significantly improve your ability to make larger payments without jeopardizing your financial stability.

Finally, communicating directly with your loan servicer is paramount. They can provide personalized guidance on available repayment options and help you navigate potential challenges. Open communication ensures you remain compliant with your loan terms and avoid penalties.

Dealing With Loan Servicers and Keeping Records

Navigating the student loan repayment process necessitates effective communication with your loan servicer. This entity manages your account, processes payments, and answers your questions. It’s crucial to understand their contact information and preferred communication methods.

Maintaining meticulous records is equally vital. Keep copies of all correspondence, payment confirmations, and any agreements related to your loans. This documentation will prove invaluable should any discrepancies arise or if you need to dispute charges. Consider using a dedicated file or digital system for easy access and organization. This proactive approach minimizes potential issues and ensures a smoother repayment journey.

Regularly review your statements to verify the accuracy of payments and interest calculations. Promptly address any inconsistencies or errors with your servicer to avoid accumulating unnecessary fees or impacting your credit score. Understanding your loan details and maintaining open communication with your servicer are key to successful repayment.

The Pros and Cons of Early Repayment

Early repayment of student loans offers several advantages. A primary benefit is the significant reduction in total interest paid. This translates to more money in your pocket over the life of the loan. Furthermore, early repayment provides financial peace of mind, freeing up your budget and reducing long-term financial stress. It can also boost your credit score, demonstrating responsible financial behavior to lenders.

However, there are also potential drawbacks to consider. Early repayment may mean sacrificing other financial goals, such as saving for a down payment on a house or investing in retirement. Depending on your loan terms, you may also incur prepayment penalties, negating some of the benefits. Finally, it’s crucial to ensure that the money used for early repayment isn’t needed for essential expenses or unexpected emergencies.

What to Do If You Can’t Pay: Deferment and Forbearance

Facing difficulty in making your student loan payments? Deferment and forbearance are options that can temporarily postpone your payments. However, they are not the same and have different implications.

Deferment is a temporary postponement of payments typically granted due to specific circumstances like unemployment, graduate school enrollment, or military service. Interest may or may not accrue depending on the type of loan and the reason for deferment. It’s crucial to understand the terms of your specific deferment.

Forbearance is also a temporary suspension of payments, but it’s usually granted for reasons such as financial hardship. Unlike deferment, interest typically accrues during forbearance, leading to a larger balance owed later. This can significantly impact your long-term repayment costs.

Before choosing either option, carefully weigh the pros and cons. Contact your loan servicer immediately to discuss your situation and explore the available options. They can help you determine the best course of action based on your specific circumstances and loan type. Failure to communicate with your lender can result in negative consequences, including damage to your credit score.

Remember to always read the fine print associated with both deferment and forbearance to fully understand the terms and conditions.

Staying Motivated on a Long Repayment Timeline

Repaying student loans can be a marathon, not a sprint. A long repayment timeline, often spanning many years, can significantly impact motivation. Maintaining consistent motivation requires a strategic approach.

Visualize your goals: Keep the ultimate reward – financial freedom – in mind. Regularly remind yourself of the benefits of paying off your loans, such as reduced financial stress and increased savings potential. Consider creating a visual reminder, like a chart tracking your progress.

Break it down: Instead of focusing on the daunting overall debt, break down your repayment journey into smaller, more manageable milestones. Celebrate these achievements along the way to maintain momentum and stay positive.

Build a support system: Discuss your repayment plan with friends, family, or a financial advisor. Sharing your goals and challenges can provide valuable support and accountability.

Reward yourself: Acknowledge your progress with small, well-deserved rewards. This positive reinforcement can help you stay committed to your repayment plan.

Stay flexible: Life throws curveballs. If unexpected expenses or life changes arise, adjust your repayment plan accordingly. Don’t let setbacks derail your overall progress. Seek advice from your loan servicer if you need to explore options like deferment or forbearance.

Regularly review your progress: Tracking your payments and monitoring your debt balance keeps you engaged and informed. This helps ensure you’re on track to meet your long-term repayment goals. Consistency is key to success in this long-term endeavor.