Are you ready to take the leap into homeownership? This first-time homebuyer’s guide to home loans and mortgages will equip you with the essential knowledge to navigate the process with confidence. Understanding mortgage rates, loan types (such as conventional loans, FHA loans, and VA loans), and the intricacies of loan applications is crucial for securing the best financing for your dream home. We’ll break down the complex world of home financing into manageable steps, guiding you through each stage, from pre-approval to closing.

From determining your affordability and understanding your credit score’s impact to selecting the right mortgage lender and negotiating terms, this guide serves as your comprehensive resource. We’ll explore various mortgage options, highlighting the pros and cons of each to help you make informed decisions. Learn about down payment assistance programs, closing costs, and how to avoid common pitfalls along the way. This guide empowers you to become a savvy borrower and achieve your homeownership goals with ease and understanding. Let’s get started on your journey to owning your first home!

What Is a Mortgage and How It Works

A mortgage is a loan used to purchase a home. It’s a long-term debt secured by the property itself. This means the lender (typically a bank or credit union) has the right to take possession of your home if you fail to make your payments.

How it works: You borrow a sum of money (the principal) to buy a house. In return, you make regular monthly payments over a set period (the loan term), usually 15 or 30 years. Each payment covers a portion of the principal and the interest charged on the loan. Interest is the cost of borrowing money. Early in the loan term, a larger portion of each payment goes toward interest, while later payments allocate more to principal.

Key aspects of a mortgage: The loan amount (how much you borrow), the interest rate (the cost of borrowing), and the loan term (the length of the loan) significantly impact your monthly payment and the total cost of the home.

Types of mortgages: There are various types of mortgages available, each with different terms and conditions. Some common types include fixed-rate mortgages (with a consistent interest rate throughout the loan) and adjustable-rate mortgages (with interest rates that fluctuate).

Understanding mortgages is crucial for first-time homebuyers. Seeking professional advice from a mortgage lender or financial advisor is highly recommended before making any decisions.

Types of Mortgages You Should Know

Choosing the right mortgage is crucial for first-time homebuyers. Several types exist, each with its own terms, interest rates, and eligibility requirements. Understanding these differences is key to making an informed decision.

Fixed-rate mortgages offer predictable monthly payments with an interest rate that remains constant throughout the loan term. This provides financial stability, though rates might be higher initially compared to other options. A 15-year fixed-rate mortgage results in quicker payoff and lower overall interest paid but requires larger monthly payments. A 30-year fixed-rate mortgage offers smaller monthly payments but accrues significantly more interest over the life of the loan.

Adjustable-rate mortgages (ARMs) feature interest rates that fluctuate based on market indices. These mortgages typically offer lower initial interest rates, making them attractive to some buyers. However, the unpredictable nature of the interest rate poses a risk of higher payments in the future. Interest-only mortgages allow borrowers to pay only the interest for a specified period, usually the initial years. The principal remains untouched, resulting in a large balloon payment at the end of the interest-only period.

FHA loans are government-insured mortgages designed to help first-time homebuyers with lower credit scores or down payments. VA loans are available to eligible veterans, active-duty service members, and surviving spouses, often requiring no down payment. USDA loans are specifically for rural properties and may offer favorable terms for those who qualify.

Jumbo mortgages exceed the conforming loan limits set by Fannie Mae and Freddie Mac. They often carry higher interest rates but are necessary for purchasing high-value properties. It is important to note that specific terms and conditions vary between lenders, so comparing offers is essential before committing.

Understanding Down Payments and Loan-to-Value

A down payment is the initial upfront cash payment you make when purchasing a home. It’s typically a percentage of the home’s purchase price. A larger down payment generally leads to more favorable loan terms, such as a lower interest rate and potentially avoiding private mortgage insurance (PMI).

Loan-to-value (LTV) ratio is a crucial factor in determining your eligibility for a mortgage and the terms you’ll receive. It’s calculated by dividing the loan amount by the home’s appraised value. For example, a $200,000 loan on a $250,000 home has an LTV of 80%. A lower LTV (meaning a higher down payment) usually results in better interest rates and potentially lower closing costs.

Understanding your LTV is essential because lenders use it to assess risk. A higher LTV indicates a greater risk for the lender, potentially leading to stricter lending requirements or a higher interest rate. Conversely, a lower LTV signifies lower risk, making it easier to qualify for a mortgage and potentially secure a better interest rate.

In summary, both your down payment and LTV ratio significantly impact your mortgage application. Aiming for a larger down payment can lead to a lower LTV, resulting in better loan terms and potentially saving you money in the long run.

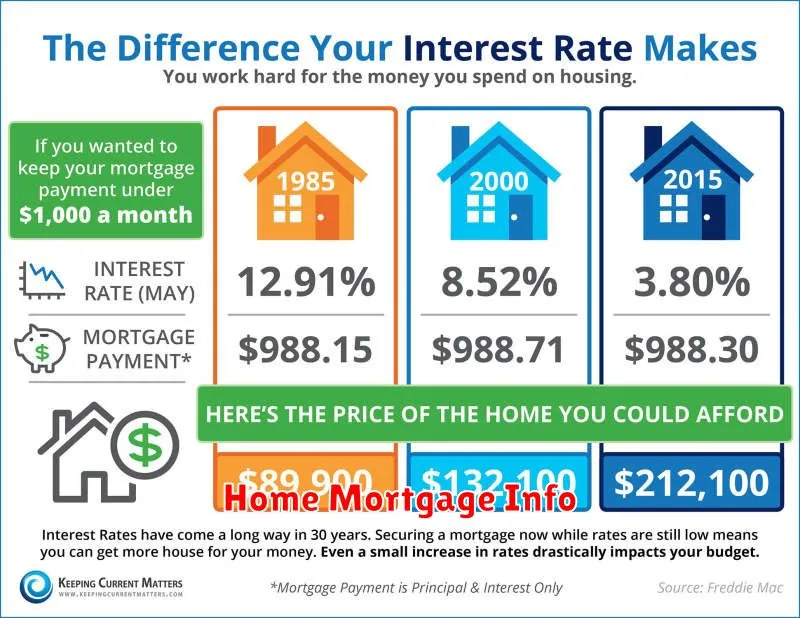

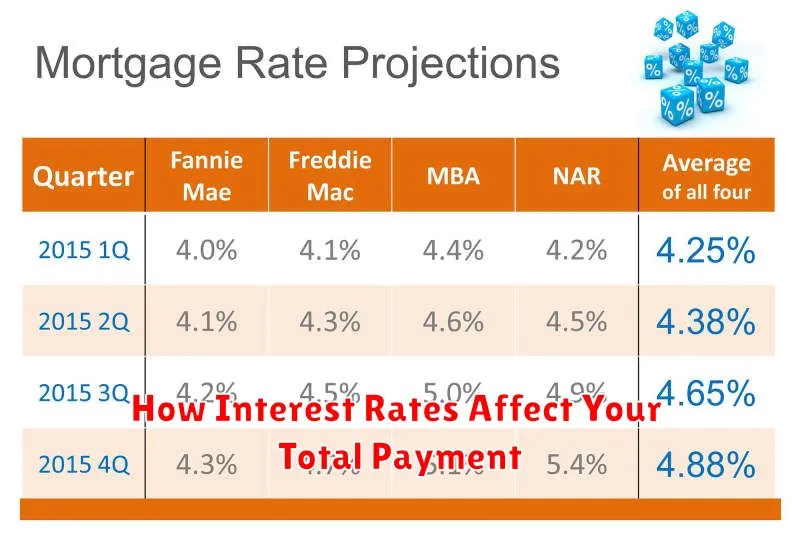

How Interest Rates Affect Your Total Payment

Understanding how interest rates impact your total home loan payment is crucial. A higher interest rate means you’ll pay more in interest over the life of the loan, resulting in a significantly larger total payment. Conversely, a lower interest rate reduces the total interest paid, leading to a lower overall cost.

Let’s illustrate: Consider two 30-year, $300,000 mortgages. One with a 6% interest rate might have a monthly payment around $1,800, resulting in a total payment exceeding $650,000. A mortgage with a 4% interest rate, however, could have a monthly payment closer to $1,400, leading to a total payment significantly lower, around $500,000. This difference highlights the substantial impact of even small interest rate fluctuations on your long-term costs.

Therefore, it’s essential to carefully consider current interest rate trends and shop around for the best rates available when securing a home loan. Even a small percentage point difference can translate into thousands of dollars saved or lost over the loan’s duration. Mortgage calculators can be helpful tools to model different interest rate scenarios and understand their influence on your total payment.

Amortization Explained in Simple Terms

Amortization is the process of gradually paying off a loan over a fixed period through regular payments. Each payment you make consists of both principal (the original loan amount) and interest (the cost of borrowing the money).

In the early stages of an amortized loan, like a mortgage, a larger portion of your payment goes towards interest. As time passes, the proportion shifts, and more of your payment goes towards reducing the principal balance. This is reflected in an amortization schedule, which details the breakdown of each payment.

Understanding amortization is crucial for homebuyers because it allows you to see clearly how your mortgage payments will decrease your loan balance over time and helps you plan your finances accordingly. The schedule also shows the total interest you will pay throughout the loan’s life.

Key takeaway: Amortization is a systematic repayment plan that ensures your loan is paid off completely within the agreed-upon timeframe.

What Is Escrow and Why It’s Important

In the context of a home loan, escrow is a crucial account managed by your lender. It holds funds to cover your property taxes and homeowner’s insurance premiums.

Your monthly mortgage payment includes an amount allocated to your escrow account. The lender then pays your taxes and insurance from this account as they come due. This ensures these essential costs are covered, preventing you from falling behind and risking foreclosure.

Why is escrow important? It simplifies your financial responsibilities by consolidating these payments into your mortgage. It eliminates the need for you to remember separate due dates and ensure timely payments for taxes and insurance, avoiding potential late fees or penalties.

While convenient, it’s important to regularly review your escrow account statement to ensure that your payments and the lender’s disbursement of funds are accurate.

The Pre-Approval Process and Documentation

Before you start house hunting, securing a pre-approval for a home loan is crucial. This involves providing a lender with financial documentation to determine your borrowing capacity.

Necessary documentation typically includes pay stubs, tax returns, bank statements, and credit reports. The lender will assess your credit score, debt-to-income ratio (DTI), and overall financial health to determine how much they’re willing to lend you.

The pre-approval process isn’t a guarantee of a loan, but it provides a strong indication of your affordability and gives you a realistic budget for your home search. It also strengthens your offer when you find a property, making you a more competitive buyer.

During this process, be prepared to answer questions about your employment history, assets, and liabilities. Accuracy and thoroughness are essential for a smooth and efficient pre-approval.

Receiving a pre-approval letter is a significant step toward homeownership. This letter outlines the loan amount you’re approved for and serves as proof of your financial readiness to real estate agents and sellers.