Navigating the world of credit card rewards can feel overwhelming, but understanding how to maximize these benefits without incurring debt is entirely achievable. This article provides a comprehensive guide to unlocking the potential of credit card rewards programs, helping you earn valuable points, miles, or cash back while maintaining responsible spending habits. Learn how to strategically choose the right card for your spending habits, avoid high-interest rates, and ultimately, earn significant rewards without compromising your financial health. We’ll demystify the complexities of credit card reward systems and equip you with the knowledge to make informed decisions.

Many people are intimidated by the prospect of managing credit cards effectively, fearing the trap of high-interest debt. However, with careful planning and a clear understanding of credit card rewards programs, you can transform your everyday spending into a source of valuable perks. This guide emphasizes responsible credit card management strategies, demonstrating how to use rewards programs to your advantage without falling into the cycle of debt. We’ll explore strategies for paying off balances on time and maximizing the benefits of your chosen credit card. Learn to leverage credit card rewards for travel, shopping, and cash back, all while staying on top of your finances.

How Reward Points, Cashback, and Miles Work

Credit card rewards programs offer various ways to earn rewards, primarily through points, cashback, or miles. Each system functions differently but ultimately provides value for cardholders.

Reward points are typically earned based on spending. The accumulation of points allows redemption for various goods and services, such as merchandise, gift cards, or statement credits, often at a predetermined rate. Point values can vary significantly between different credit card issuers.

Cashback, as its name suggests, rewards a percentage of your spending directly back to you in the form of cash. This can be credited to your account as a statement credit or deposited into a linked bank account. Cashback rates can differ based on spending categories and promotional periods.

Miles are similar to points but are specifically designed for travel rewards. Miles are earned through spending and can be redeemed for flights, hotel stays, car rentals, or other travel-related expenses with affiliated airlines and partners. The number of miles needed for redemption varies significantly based on the destination and travel dates.

Understanding how these reward systems work is crucial to maximizing the benefits of a rewards credit card. Always carefully read the terms and conditions of your specific card to understand the earning rates, redemption options, and any limitations.

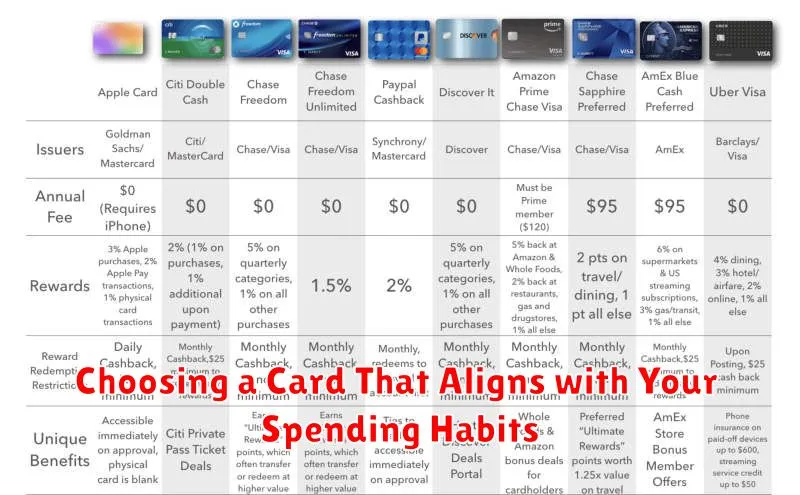

Choosing a Card That Aligns with Your Spending Habits

Selecting a credit card that complements your spending habits is crucial for maximizing rewards and avoiding unnecessary debt. Understanding your spending patterns – whether it’s groceries, travel, or dining – is the first step.

Cash-back cards are versatile and offer a percentage back on all purchases, making them ideal for diverse spending. Travel cards provide significant rewards on airfare and hotels, beneficial for frequent travelers. Retail-specific cards offer boosted rewards at particular stores, best for those who frequently shop at those locations.

Consider the annual fee, if any. A higher annual fee might be justified by substantial rewards if your spending aligns perfectly with the card’s benefits. However, if your spending doesn’t reach the threshold to offset the fee, a no-annual-fee card might be more suitable. Carefully evaluate the interest rate (APR); a high APR can quickly negate any rewards earned if balances aren’t paid in full monthly.

Compare cards based on your spending habits and prioritize cards that offer rewards in categories where you spend the most. Remember, responsible spending is paramount. Only use a credit card if you can comfortably pay your balance in full each month to avoid accruing interest and debt.

Paying in Full vs Carrying a Balance

A crucial aspect of maximizing credit card rewards without succumbing to debt lies in understanding the difference between paying your balance in full and carrying a balance. Paying in full each month eliminates interest charges, allowing you to enjoy the rewards without incurring additional costs. This is the most effective strategy for responsible credit card use.

Conversely, carrying a balance means you’re only paying a portion of your statement balance. This incurs high interest charges, significantly offsetting any rewards earned. The interest rates on credit cards are typically much higher than other forms of debt, making carrying a balance a costly practice that quickly diminishes the value of any rewards program.

Therefore, the key to responsible credit card usage is to prioritize paying your balance in full each month. While rewards programs offer enticing benefits, the cost of carrying a balance far outweighs any potential rewards, potentially leading to a cycle of debt.

Why Rewards Aren’t Worth It If You’re in Debt

While credit card rewards programs can seem appealing, they are generally not worthwhile if you’re carrying significant debt. The interest you pay on your outstanding balance far outweighs any potential rewards earned.

High interest rates on credit card debt typically range from 15% to 30% annually. This means that the money you’re accruing in rewards is dwarfed by the amount you’re paying in interest. For example, a $100 cash back reward is insignificant compared to the hundreds or even thousands of dollars you might be paying in interest each year.

Focusing on debt repayment should be your top priority. Aggressively paying down high-interest debt will save you substantially more money in the long run than any rewards program could offer. Once your debt is under control, then you can explore the benefits of rewards programs more effectively.

In short, the opportunity cost of using a credit card for rewards when you’re in debt is extremely high. Prioritize paying off your debt before considering the advantages of rewards programs.

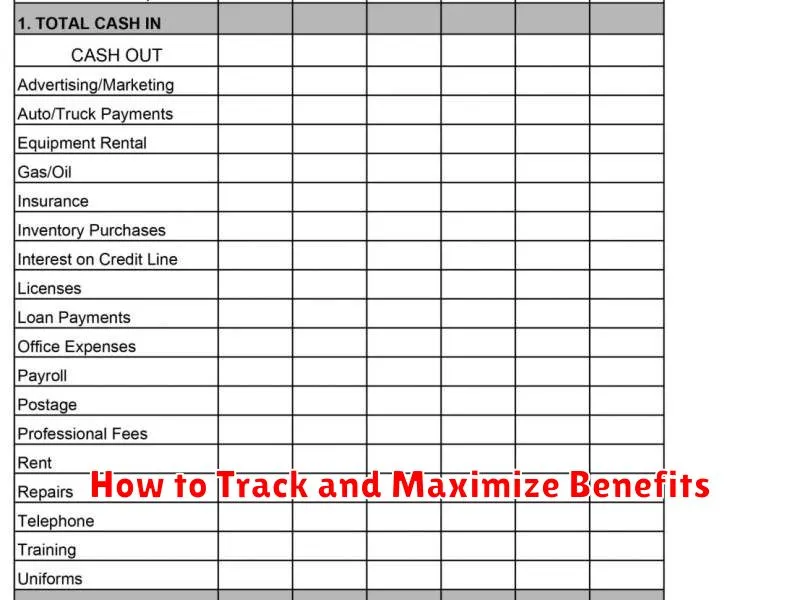

How to Track and Maximize Benefits

Effectively tracking your credit card rewards is crucial to maximizing their value. Start by choosing a method that suits you – a spreadsheet, a dedicated rewards tracking app, or even your credit card company’s online portal. Consolidate all your cards in one place for a comprehensive overview.

Next, understand your rewards program. Familiarize yourself with the terms and conditions, including expiration dates, point redemption values, and any restrictions on redemption options. This will help you make informed spending decisions.

Strategically use your cards to earn the most rewards. If possible, concentrate your spending on categories offering bonus rewards or higher earning rates. For example, focus your grocery spending on a card that offers bonus points on groceries.

Finally, monitor your spending and rewards balance regularly. This prevents surprises and helps you stay on track towards your redemption goals. Set reminders for upcoming deadlines and planned redemptions. Remember that maximizing benefits involves mindful spending, not overspending.

Avoiding Overspending to Chase Rewards

The allure of credit card rewards can be tempting, but it’s crucial to avoid overspending simply to earn them. Responsible credit card use hinges on spending only what you can comfortably afford to repay each month.

Before applying for a rewards card, carefully evaluate your spending habits. Determine if the rewards offered align with your existing spending patterns. If you need to drastically alter your spending habits to maximize rewards, it’s a red flag suggesting the card may not be suitable.

Budgeting is paramount. Create a detailed budget that outlines your income and expenses. Allocate a specific amount for credit card spending, ensuring it remains within your means. Tracking your spending closely, either manually or using budgeting apps, will help you stay on track.

Prioritize paying your balance in full and on time. Carrying a balance incurs interest charges, negating the value of any rewards earned. The interest accrued will quickly outweigh any benefits from the rewards program. Focus on responsible spending to maintain a healthy credit score.

Remember, rewards are a bonus, not the primary objective. Using credit cards strategically for rewards shouldn’t lead to financial hardship. Prioritizing responsible spending practices will ultimately ensure you benefit from your rewards program without jeopardizing your financial well-being.

When to Consider Downgrading or Switching Cards

Downgrading or switching credit cards can be beneficial in certain situations. Consider downgrading if you’re no longer meeting the requirements for a premium card, such as spending a certain amount annually to retain its benefits, or if the annual fee outweighs the rewards you’re receiving. A simpler card with lower fees could be a more financially responsible option.

Switching cards is a strategic move if you find a better card that aligns with your spending habits and offers more valuable rewards. This could involve finding a card with higher cash-back percentages in categories you frequently use, or one that offers better travel rewards if you’re a frequent traveler. Carefully compare interest rates and fees before switching to ensure the new card is truly superior.

Before making any changes, assess your credit utilization and overall credit score. Closing a card can negatively impact your credit score if it lowers your available credit. If downgrading or switching, aim to maintain a healthy credit history and utilization ratio to ensure your credit remains strong.