Understanding your credit card score is crucial for achieving your financial goals. Whether you’re aiming for a mortgage, auto loan, or simply seeking the best interest rates, your credit score plays a significant role. This article will delve into the factors that truly impact your credit score, dispelling common myths and providing you with actionable steps to improve your financial standing. We’ll examine the key components that determine your score, including payment history, amounts owed, length of credit history, new credit, and the credit mix. Learn how these elements contribute to your overall score and discover strategies to boost it effectively.

Many individuals struggle to comprehend the complexities of their credit reports and the resulting credit score. This guide will simplify the process, breaking down each scoring factor into easily digestible information. We’ll explore how seemingly small actions, such as paying bills on time or managing your credit utilization ratio, can significantly impact your score over time. By the end of this article, you will have a comprehensive understanding of what influences your credit card score, allowing you to take control of your financial future and improve your creditworthiness.

How Credit Cards Impact Your Credit Score

Your credit card usage significantly influences your credit score. Payment history is the most crucial factor; consistently paying your bills on time is paramount. Late or missed payments severely damage your score.

The amount of credit you use relative to your total available credit (credit utilization ratio) is another key element. Keeping your credit utilization low (ideally below 30%) demonstrates responsible credit management and positively impacts your score.

The age of your credit accounts also matters. A longer credit history, including the age of your oldest credit card, suggests financial stability and contributes to a higher score. Opening too many accounts too quickly can negatively impact your score.

The types of credit you use are considered, with a mix of credit cards and other loan types (e.g., auto loans, mortgages) often viewed favorably. However, focusing solely on credit cards may not be as beneficial.

Finally, the number of credit inquiries (hard inquiries) on your credit report can temporarily lower your score. Many inquiries in a short period indicate potential financial risk. It’s wise to limit applications for new credit to only when necessary.

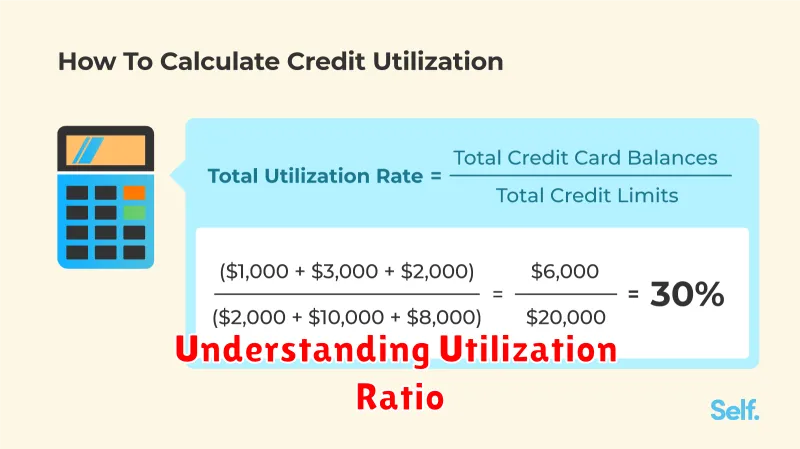

Understanding Utilization Ratio

Your credit utilization ratio is a crucial factor influencing your credit score. It represents the percentage of your available credit that you’re currently using. For example, if you have a $1,000 credit limit and a $500 balance, your utilization ratio is 50%.

Keeping your utilization ratio low is key. Credit scoring models generally view high utilization ratios (above 30%) negatively. This suggests you might be struggling to manage your debt. A lower utilization ratio (ideally below 10%) signals responsible credit management.

Monitoring and managing your utilization ratio is straightforward. Pay down balances regularly to reduce your utilization. Increasing your available credit can also lower your utilization ratio, but only do so if you can manage the increased spending limit responsibly. Avoid opening multiple new cards in a short period.

Improving your utilization ratio directly contributes to a better credit score, leading to more favorable interest rates and potentially better loan terms in the future. Consistent and responsible credit card management is paramount.

Why Payment History Matters Most

Your payment history is the most significant factor influencing your credit card score, accounting for 35% of your total score. This is because consistent, on-time payments demonstrate your reliability and responsible borrowing behavior to lenders.

Even one missed payment can negatively impact your score, significantly more than other factors. Late payments remain on your credit report for seven years, persistently affecting your creditworthiness during that period.

Conversely, a long history of on-time payments builds a positive credit profile, showcasing your financial responsibility and increasing your chances of securing loans or credit cards with favorable terms in the future. Maintaining a strong payment history is crucial for obtaining the best possible interest rates and credit limits.

Therefore, prioritizing timely payments is paramount for maximizing your credit score and achieving your financial goals. Consistent and prompt payments are the cornerstone of good credit.

The Role of Credit Age and New Applications

Your credit age, representing the length of your credit history, significantly impacts your credit score. Lenders view a longer credit history as a positive indicator of responsible credit management. A longer history demonstrates your ability to consistently manage credit over time.

Conversely, frequently applying for new credit accounts can negatively affect your score. Each application results in a hard inquiry on your credit report, which temporarily lowers your score. Numerous applications within a short period suggest increased risk to lenders, implying potential financial instability. Therefore, it’s advisable to limit new credit applications to only when truly necessary.

The ideal approach involves maintaining a healthy mix of established credit accounts while carefully considering the need for new ones. Balancing these two factors contributes to a stronger, more favorable credit profile.

How to Monitor Your Score Without Hurting It

Regularly checking your credit score is crucial for maintaining good financial health. However, frequent hard inquiries can negatively impact your score. To avoid this, utilize the free credit score access offered by many banks and credit card companies. These often provide a soft inquiry, which doesn’t affect your score.

Alternatively, consider using a reputable credit monitoring service that offers regular score updates via soft inquiries. Be cautious of services promising dramatic score improvements – these are often scams. Focus on services that provide educational resources alongside score monitoring.

Remember, understanding your score’s components – such as payment history, amounts owed, length of credit history, credit mix, and new credit – is key. By monitoring these elements regularly and responsibly, you can identify potential issues and address them proactively, improving your score organically without resorting to practices that hurt it.

Myths About Credit Cards You Should Ignore

Many misconceptions surround credit cards and their impact on your credit score. Ignoring these myths can significantly improve your financial health.

Myth 1: Using a credit card lowers your credit score. This is false. Responsible credit card use, including paying on time and keeping your balances low, actually builds your credit score. The key is responsible management.

Myth 2: Closing old credit cards improves your score. Often, the opposite is true. Closing older accounts can actually hurt your credit score by lowering your credit history length and potentially your credit utilization ratio. Keeping older accounts open, even if you don’t use them, can benefit your score.

Myth 3: Only high credit card limits are beneficial. While a higher limit can improve your credit utilization ratio (the percentage of available credit used), it’s crucial to manage your spending to keep this ratio low. A high limit doesn’t automatically lead to a higher score if you consistently max out your card.

Myth 4: Applying for many cards quickly boosts your credit score. Applying for multiple cards in a short period significantly impacts your score negatively. Each application creates a hard inquiry on your credit report, which can temporarily lower your score. It is best to apply for new credit cards only when needed.

Myth 5: Paying only the minimum payment is okay. This is a costly mistake. Paying only the minimum leaves a significant balance, which negatively impacts your credit utilization ratio and can lead to interest charges significantly impacting your credit history. Always aim to pay your balance in full each month.

Understanding these common myths and focusing on responsible credit card management is key to building and maintaining a strong credit score.

Building Positive Habits with Responsible Use

Building positive habits with your credit card is crucial for maintaining a strong credit score. Responsible use centers around consistently demonstrating your ability to manage debt effectively.

Paying your bills on time is paramount. Even a single late payment can negatively impact your score. Set up automatic payments or reminders to ensure timely payments.

Keeping your credit utilization ratio low is equally important. This ratio represents the amount of credit you’re using compared to your total available credit. Aim to keep it below 30%, ideally much lower. Avoid maxing out your cards.

Diversifying your credit by using different types of credit accounts (credit cards, loans) responsibly can also positively affect your score, showcasing your creditworthiness.

Finally, avoid applying for too many new credit accounts within a short period. Each application leads to a hard inquiry on your credit report, which can temporarily lower your score. Only apply when absolutely necessary.