Understanding the intricacies of home loans can feel daunting, but grasping the basics is crucial for making informed decisions about one of life’s biggest financial commitments. This article demystifies the structure of home loans, explaining key concepts like mortgage rates, loan terms, and different loan types. Whether you’re a first-time homebuyer or simply seeking a better understanding of your existing mortgage, this guide provides a clear and concise overview to empower you in navigating the home loan process.

We’ll explore the essential components that shape your home loan, including the various types of mortgages available, such as fixed-rate and adjustable-rate mortgages (ARMs). Understanding the implications of interest rates, loan amortization, and closing costs is paramount to securing a home loan that aligns with your financial goals and long-term stability. By the end of this article, you’ll possess a solid foundation in home loan basics, enabling you to make confident and well-informed choices regarding your future home purchase.

What Is a Mortgage and How It Works

A mortgage is a loan used to purchase a home. The home itself serves as collateral for the loan, meaning the lender can seize the property if the borrower defaults on the loan payments.

The process typically begins with a loan application, where the borrower provides financial information to the lender. The lender then assesses the borrower’s creditworthiness and the value of the property to determine the loan amount and interest rate. This involves a process called underwriting, where the lender evaluates the borrower’s risk.

Once approved, the borrower receives the loan funds to purchase the home. The loan is then repaid over a specified period, typically 15 or 30 years, through monthly installments. These payments include principal (the original loan amount) and interest.

Interest rates can vary significantly based on several factors including the borrower’s credit score, the loan type, and prevailing market conditions. There are different types of mortgages, including fixed-rate mortgages (where the interest rate remains constant throughout the loan term) and adjustable-rate mortgages (where the interest rate can fluctuate over time).

Understanding the terms and conditions of a mortgage is crucial before signing any agreements. It’s recommended to shop around for the best rates and terms and seek professional advice from a financial advisor if needed.

Down Payment Requirements Explained

A down payment is the initial amount of money you pay upfront when purchasing a home. This amount is typically expressed as a percentage of the home’s purchase price. The larger your down payment, the lower your loan amount will be, and often the better your interest rate.

Conventional loans often require a minimum down payment of 3% to 20%, although some lenders may offer options with even lower down payments. These loans are not insured by the government and tend to have stricter requirements.

FHA loans, backed by the Federal Housing Administration, typically require a down payment as low as 3.5%, making homeownership more accessible to first-time buyers or those with lower credit scores. However, they require mortgage insurance premiums.

VA loans, guaranteed by the Department of Veterans Affairs, may allow for zero down payment for eligible veterans and active-duty military personnel. However, funding fees may apply.

The required down payment will vary based on several factors including the type of loan, your credit score, the lender, and the property itself. It’s essential to shop around and compare loan options to find the best fit for your financial situation. Always consult with a qualified mortgage lender to determine your eligibility and understand the specific down payment requirements for your chosen loan.

Types of Mortgage Loans (Fixed, ARM, FHA)

Choosing a mortgage is a crucial step in the home-buying process. Understanding the different types available is essential for making an informed decision. Three common types are fixed-rate mortgages, adjustable-rate mortgages (ARMs), and Federal Housing Administration (FHA) loans.

A fixed-rate mortgage offers a consistent interest rate throughout the loan term, providing predictable monthly payments. This predictability makes budgeting easier, but the interest rate may not be as competitive as other options.

An adjustable-rate mortgage (ARM) features an interest rate that fluctuates over time, typically based on an index like the LIBOR. Initial interest rates are often lower than fixed-rate mortgages, but they can increase significantly, leading to higher monthly payments. The risk is higher, but the initial lower rate can be attractive to some borrowers.

An FHA loan is insured by the Federal Housing Administration, making it easier for borrowers with lower credit scores or down payments to qualify. These loans typically require a smaller down payment (as low as 3.5%) compared to conventional loans, but they come with mortgage insurance premiums.

The best type of mortgage for you depends on your individual financial situation, risk tolerance, and long-term goals. Carefully consider the pros and cons of each before making a decision.

The Role of Interest Rates and How They’re Set

Interest rates are a fundamental component of home loans, directly impacting the total cost of borrowing. They represent the lender’s cost of funds and the risk associated with lending. The higher the rate, the more expensive the loan.

Several factors influence interest rate determination. The Federal Reserve plays a significant role by setting the federal funds rate, influencing other interest rates throughout the economy. Economic conditions, such as inflation and unemployment, also have a substantial impact. Lender’s assessment of borrower creditworthiness further shapes individual interest rates. A borrower with a strong credit history typically receives a lower rate.

The process of setting a specific home loan interest rate involves the lender considering various factors. These include the prevailing market interest rates, the borrower’s credit score, the loan-to-value ratio (LTV), and the loan term. The final interest rate is a reflection of the lender’s perceived risk and the prevailing market conditions.

Understanding how interest rates are set and their impact on the overall cost is crucial for homebuyers. By understanding these dynamics, borrowers can make more informed decisions when securing a mortgage.

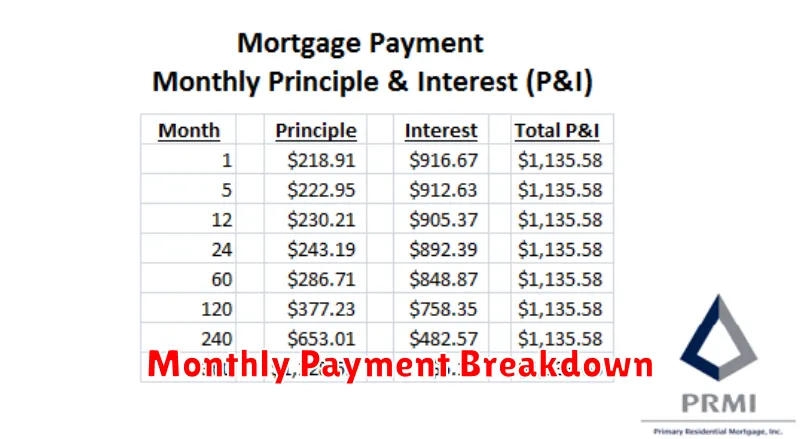

Monthly Payment Breakdown

Your monthly mortgage payment is comprised of several key components. The largest portion is typically the principal, which is the amount you borrowed to purchase the home. A significant portion also goes towards interest, the cost of borrowing the money. The interest rate is a crucial factor influencing your overall payment.

In addition to principal and interest, your monthly payment includes property taxes and homeowners insurance. These are often paid through your lender in a process called escrow. The lender collects these funds along with your principal and interest payment, ensuring timely payment of these crucial expenses.

Some mortgages may also include private mortgage insurance (PMI) if your down payment was less than 20% of the home’s purchase price. PMI protects the lender in case you default on the loan. Finally, you may have Homeowners Association (HOA) fees if your home is part of a community with shared amenities.

Understanding the breakdown of your monthly payment is critical to budgeting effectively and managing your homeownership costs. Carefully review your mortgage documents to fully grasp each component and its impact on your finances.

Escrow, PMI, and Other Hidden Costs

Beyond the principal and interest, several additional costs are often associated with home loans. Understanding these “hidden” costs is crucial for accurate budgeting.

Escrow accounts hold funds for property taxes and homeowner’s insurance. These payments are typically collected monthly along with your mortgage payment, ensuring timely coverage.

Private Mortgage Insurance (PMI) is usually required if your down payment is less than 20% of the home’s purchase price. PMI protects the lender against losses if you default on the loan. It’s an added monthly expense that can be significant.

Other potential costs include homeowner’s association (HOA) fees (if applicable), closing costs (fees associated with finalizing the loan), and potential prepayment penalties if you pay off your loan early.

Carefully review your loan documents and budget accordingly to account for all these expenses. A knowledgeable lender can help clarify these costs and incorporate them into your overall financial plan.

How to Read Your Loan Estimate Document

The Loan Estimate (LE) is a crucial document you’ll receive from your lender when applying for a home loan. It provides a clear picture of the estimated costs associated with your mortgage. Understanding it is vital before committing to a loan.

Start by reviewing the loan terms. This section details the loan amount, interest rate, and loan type (e.g., fixed-rate, adjustable-rate). Pay close attention to the Annual Percentage Rate (APR), which reflects the total cost of the loan including fees.

Next, carefully examine the closing costs. This section breaks down various fees, such as appraisal fees, title insurance, and lender fees. Note that some costs are paid upfront at closing, while others may be rolled into the loan amount.

The LE also outlines your monthly payments, including principal, interest, taxes, and insurance (often referred to as PITI). Compare this to your budget to ensure affordability.

Finally, review the loan disclosures and caveats. These sections highlight any potential changes in costs or terms. Remember, the LE is an estimate, and final costs may vary slightly.

If anything is unclear or seems inaccurate, don’t hesitate to contact your lender for clarification before proceeding.