Understanding how credit cards truly function is crucial for responsible financial management. Many individuals harbor misconceptions about credit card mechanics, leading to debt accumulation and damaged credit scores. This article will dispel common myths and provide a clear explanation of how credit cards work, from the moment you swipe to the impact on your credit report. We’ll cover key aspects such as interest rates, APR (Annual Percentage Rate), credit limits, and the importance of payment due dates. Learn how to leverage credit cards effectively to build credit and avoid the pitfalls of excessive debt.

We’ll delve into the often misunderstood intricacies of credit card processing, revealing the hidden costs and fees associated with credit card usage. Discover the secrets to maintaining a healthy credit score and maximizing the benefits of responsible credit card use. This comprehensive guide will equip you with the knowledge necessary to navigate the world of credit cards confidently and make informed financial decisions, ultimately leading to improved financial well-being. Understanding credit card debt and how to manage it is paramount; we’ll outline strategies for responsible spending and effective debt management.

What Is a Credit Card and How It Differs from Debit

A credit card is a thin rectangular piece of plastic that allows you to borrow money from a financial institution to make purchases. You are essentially taking out a short-term loan each time you use it. Payments are made later, usually monthly, with interest charged on outstanding balances.

A debit card, on the other hand, is directly linked to your checking account. When you use a debit card, the funds are immediately deducted from your account. It’s essentially a more convenient way to use your existing money.

The key difference lies in the source of funds. Credit cards use borrowed money, while debit cards use your own money. This distinction significantly impacts your financial responsibility and potential for debt accumulation.

Another important distinction is the credit history impact. Responsible use of a credit card helps build a positive credit history, which is crucial for obtaining loans, mortgages, and even some rental agreements. Debit card usage does not impact your credit score.

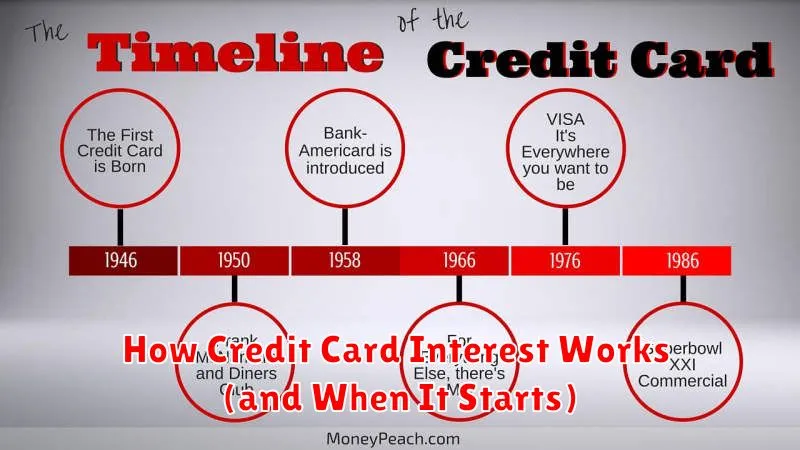

How Credit Card Interest Works (and When It Starts)

Credit card interest, also known as finance charges, is the cost you pay for borrowing money from the credit card issuer. It’s calculated as a percentage of your outstanding balance, the amount you owe at the end of a billing cycle.

The annual percentage rate (APR) is the yearly interest rate. This rate is usually stated clearly on your credit card agreement. However, it’s important to understand that this is often not a single, fixed rate. It can be variable, fluctuating with market conditions, and often includes additional fees that increase your actual cost of borrowing.

Interest typically starts accruing on the day you make a purchase if you don’t pay your balance in full by the due date. This means that even if you only carry a small balance, you begin accumulating interest charges immediately. The longer you carry a balance, the more interest you’ll pay. If you pay your balance in full each month, you avoid interest charges altogether. This is crucial to understanding the cost of using a credit card.

The way interest is calculated can vary slightly depending on the issuer. Some use a method called the average daily balance method, which calculates interest based on the average daily balance over the billing cycle. Others may use a different method, so understanding your specific card agreement is vital.

Understanding how credit card interest works is crucial to managing your finances effectively. By paying your balance in full each month, you can avoid paying any interest and benefit from the convenience of credit cards without incurring unnecessary expenses.

Minimum Payment Myths and Realities

Many believe paying only the minimum payment on a credit card is a harmless strategy. This is a dangerous myth.

Reality: Minimum payments barely cover interest charges. The vast majority of your payment goes towards interest, leaving the principal balance largely untouched. This leads to significantly higher total costs and a much longer repayment period.

Another myth is that consistently paying the minimum will improve your credit score. While on-time payments are crucial for credit health, paying only the minimum demonstrates poor financial management and doesn’t reflect positive credit behavior.

Reality: Consistently making only minimum payments can negatively impact your credit score. A high credit utilization ratio (the amount of credit used compared to your credit limit) resulting from a large outstanding balance hurts your creditworthiness.

Finally, a common myth is that minimum payments are a convenient way to manage debt. While convenient in the short term, this reality is ultimately costly and can trap you in a cycle of debt.

Reality: Paying more than the minimum payment dramatically reduces the amount of interest accrued and significantly shortens the repayment timeframe, ultimately saving you considerable money. Prioritizing higher payments is crucial for responsible credit card management.

Common Traps to Avoid Like the Annual Fee Spiral

One of the biggest mistakes credit card users make is falling into the annual fee spiral. Many cards offer attractive rewards, but these often come with hefty annual fees. If the rewards don’t outweigh the fees, you’re essentially paying to use the card.

Avoid this trap by carefully comparing the value of the rewards program against the annual fee. Consider your spending habits: will you actually earn enough rewards to justify the cost? If not, opt for a card with no annual fee or a lower one.

Another common pitfall is the balance transfer trap. While tempting to transfer high-interest balances to a card with a 0% introductory APR, be aware of the potential for high fees and the eventual return to a high interest rate. Carefully calculate the total cost including fees and interest to determine if it’s truly beneficial.

Finally, be wary of promotional periods. Introductory offers like 0% APR or bonus rewards are often temporary. After the promotional period ends, the interest rate or rewards structure may change significantly, resulting in unexpected costs.

By understanding these common pitfalls and planning accordingly, you can maximize the benefits of credit cards while minimizing the risks and unexpected expenses.

How to Use Credit Cards Responsibly and Safely

Responsible credit card use begins with understanding your spending habits. Track your expenses carefully to avoid exceeding your credit limit. Paying your balance in full and on time each month is crucial to building a good credit score and avoiding high interest charges.

Choose credit cards with low interest rates and favorable terms. Read the fine print carefully, paying close attention to fees such as annual fees, late payment fees, and foreign transaction fees. Avoid unnecessary fees by managing your spending and ensuring timely payments.

Protect your card information diligently. Never share your card number, expiration date, or CVV code with anyone unless you’re making a secure online purchase from a reputable vendor. Monitor your credit card statements regularly for any unauthorized transactions and report suspicious activity immediately to your bank.

Consider using a credit card for purchases that offer rewards or cash-back programs. However, be mindful of the potential for overspending to chase rewards. Always prioritize responsible spending over accumulating rewards points.

In summary, responsible and safe credit card use hinges on mindful spending, timely payments, and vigilant security practices. By adhering to these guidelines, you can maximize the benefits of a credit card while mitigating the risks.

Credit Utilization Ratio Explained

Your credit utilization ratio (CUR) is a crucial factor influencing your credit score. It represents the percentage of your total available credit that you’re currently using. This is calculated by dividing your total credit card balances by your total credit limit. For example, if you have a $10,000 credit limit and a $2,000 balance, your CUR is 20%.

A low CUR is generally better for your credit score. Experts recommend keeping your CUR below 30%, and ideally below 10%. A high CUR suggests you’re heavily reliant on credit, increasing the perceived risk to lenders. This can negatively impact your creditworthiness and make it harder to obtain loans or secure favorable interest rates in the future.

Managing your CUR involves paying down your credit card balances regularly. Paying more than the minimum payment each month will significantly reduce your CUR and improve your credit score over time. Regularly reviewing your credit report to monitor your CUR is also essential for proactive credit management.

How to Read Your Credit Card Statement Properly

Understanding your credit card statement is crucial for managing your finances effectively. The statement provides a detailed summary of your account activity for a given billing cycle. Key sections to focus on include:

Previous balance: This shows the amount you owed at the beginning of the billing cycle. Payments: This section lists all payments made during the billing cycle. Purchases: This details all transactions made using your credit card, including the date, merchant, and amount. Credits: Any credits applied to your account, such as refunds or adjustments, are shown here. Interest charges: This indicates the interest accrued on your outstanding balance. New balance: This is the total amount you owe at the end of the billing cycle. Minimum payment due: The minimum amount you must pay to avoid late fees. Due date: The date by which your payment must be received.

Carefully review each transaction listed to ensure accuracy. Report any discrepancies immediately to your credit card issuer. Understanding these components allows you to monitor your spending, track payments, and avoid accumulating high interest charges. Pay close attention to the due date to avoid late payment fees. Paying more than the minimum payment each month can significantly reduce the total interest paid over time.

Regularly checking your statement also helps detect potentially fraudulent activity. By becoming familiar with the statement’s structure, you’ll be better equipped to manage your credit card responsibly and avoid financial pitfalls.