Considering a personal loan? It can be a powerful financial tool for various needs, from debt consolidation and home improvements to unexpected medical expenses or funding a large purchase. However, before you apply, it’s crucial to understand if a personal loan is the right financial decision for your specific situation. This comprehensive guide will walk you through key factors to consider, helping you determine whether a personal loan aligns with your financial goals and budget. We’ll explore the pros and cons, help you compare interest rates and loan terms, and guide you toward making a well-informed choice.

Understanding the nuances of personal loans is paramount to avoid potential pitfalls. This article will equip you with the knowledge to assess your credit score impact, calculate your monthly payments, and compare offers from different lenders to secure the most favorable loan terms. We’ll delve into the process of applying for a personal loan, addressing common concerns and highlighting crucial considerations like APR (Annual Percentage Rate) and fees. By the end of this guide, you’ll be confident in your ability to decide if a personal loan is the best solution for your financial needs.

When a Personal Loan Makes Financial Sense

A personal loan can be a financially sound decision under specific circumstances. It’s particularly advantageous when you need to consolidate high-interest debt, such as credit card balances. The lower, fixed interest rate of a personal loan can significantly reduce your overall interest payments and shorten the repayment period.

Large, unexpected expenses, like emergency home repairs or significant medical bills, can also justify a personal loan. Borrowing at a fixed rate provides a predictable repayment schedule, offering financial stability during a challenging time. This is preferable to accumulating high-interest debt on credit cards to cover such costs.

Furthermore, a personal loan can be a useful tool for major purchases, provided you have a clear repayment plan. For example, financing a necessary appliance or consolidating smaller debts to buy a vehicle may be more efficient than using multiple high-interest credit cards. However, carefully weigh the costs against the benefits, ensuring the purchase aligns with your financial goals.

Finally, consider a personal loan for home improvements that increase your home’s value and potentially lower your monthly expenses (such as energy-efficient upgrades). The increase in home equity may offset the loan’s cost. However, always research potential return on investment before proceeding.

Crucially, before taking out a personal loan, compare interest rates and terms from multiple lenders to secure the most favorable offer. Ensure that you can comfortably manage the monthly payments without compromising other essential financial obligations.

Red Flags That Signal You Should Avoid Borrowing

Several red flags can indicate that taking out a personal loan is not advisable for your current financial situation. One major warning sign is a high interest rate, exceeding what’s considered reasonable for your creditworthiness. This will significantly increase the overall cost of the loan.

Another crucial indicator is inability to comfortably afford the monthly payments. Carefully assess your existing budget. If incorporating the loan payments strains your finances, it’s a clear sign to reconsider borrowing. Unexpected expenses or job instability further exacerbate this risk.

Unclear or hidden fees represent a substantial red flag. Scrutinize the loan agreement for any ambiguous clauses or charges that could unexpectedly inflate the total cost. A reputable lender will provide transparent and readily understandable terms.

Finally, pressure from the lender to make a hasty decision should raise serious concerns. Legitimate lenders prioritize responsible lending practices and won’t pressure you into borrowing beyond your comfort level or financial capacity. Take your time, thoroughly research all options, and only borrow when it makes financial sense.

Alternatives to Consider First

Before applying for a personal loan, explore alternative financing options. Utilizing savings is the most straightforward approach. If savings are insufficient, consider negotiating with creditors for extended payment plans or lower interest rates. This can avoid the added cost of a personal loan.

Credit cards might offer a short-term solution for smaller expenses, though high interest rates should be carefully considered. Check if your employer provides an employee assistance program (EAP) offering financial counseling or short-term loans.

Finally, explore family or friend loans. These often come with lower interest rates or no interest at all, but formal agreements are essential to avoid future complications.

How to Match Loan Terms with Your Financial Goals

Matching loan terms to your financial goals is crucial for successful borrowing. Interest rates significantly impact the total cost; a lower rate saves you money over the loan’s life. Consider your budget and choose a monthly payment you can comfortably afford. A longer loan term lowers monthly payments but increases the total interest paid. Conversely, a shorter term raises monthly payments but reduces overall interest.

Your financial goals should drive your loan term selection. For example, if you need a loan for debt consolidation, a shorter term might be preferable to aggressively pay down debt and save on interest. If you’re using a loan for home improvements with a longer payoff horizon, a longer term may be more manageable. Carefully assess the trade-off between monthly affordability and total interest paid to align with your specific financial situation and goals.

Before signing any loan agreement, thoroughly review the terms and conditions, including fees and APR (Annual Percentage Rate). Compare offers from multiple lenders to find the best fit for your financial situation and goals. Responsible borrowing involves understanding the loan’s implications on your long-term financial health.

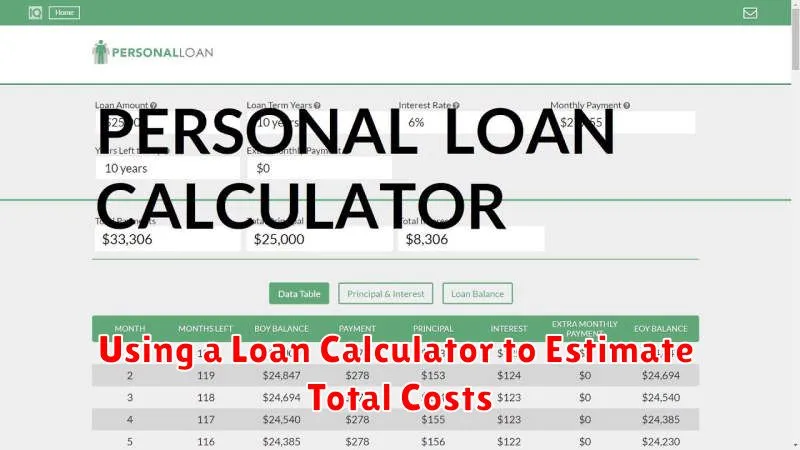

Using a Loan Calculator to Estimate Total Costs

Before committing to a personal loan, accurately estimating the total cost is crucial. A loan calculator is an invaluable tool for this purpose. These readily available online calculators require you to input key information such as the loan amount, interest rate, and loan term (length of repayment).

By inputting this data, the calculator will provide a detailed breakdown of your monthly payments and the total interest paid over the life of the loan. This allows you to see the total repayment cost – the sum of the principal loan amount and the total interest. Understanding this total cost helps you budget effectively and determine if the loan fits within your financial capabilities.

Remember that different lenders offer various interest rates and loan terms. Therefore, using a loan calculator for multiple loan offers is advisable. This comparative analysis helps you identify the most cost-effective loan option, ensuring you choose a loan that minimizes your overall expense.

Evaluating Risk vs. Benefit Honestly

Before taking out a personal loan, honestly assess your financial situation. Consider your current debt, monthly income, and spending habits. A realistic budget is crucial to determine if you can comfortably manage loan repayments without jeopardizing your financial stability.

Weigh the potential benefits against the risks. While a personal loan can provide immediate financial relief or fund important purchases, it also incurs interest charges that add to the total cost. Carefully calculate the total repayment amount, including interest, and ensure it aligns with your financial capabilities. Missing payments can severely damage your credit score.

Explore alternative financing options. Can you delay the purchase or find a less expensive solution? Consider borrowing from family or friends, or using savings if possible. These options often eliminate interest and minimize financial risk.

Transparency is key. Read the loan agreement thoroughly, understanding all terms and conditions, including fees and interest rates. Don’t hesitate to ask lenders for clarification on anything unclear. Making an informed decision based on a clear understanding of the risks and benefits is vital to responsible borrowing.

Questions to Ask Before You Apply

Before applying for a personal loan, carefully consider your financial situation. Ask yourself: What is my credit score? A higher score typically leads to better interest rates. What is my debt-to-income ratio (DTI)? A lower DTI demonstrates responsible borrowing. What is the total loan amount I need, and can I comfortably afford the monthly payments, including interest?

Next, thoroughly research the loan terms offered by different lenders. Compare interest rates, fees (origination, prepayment penalties), and repayment periods. Understand the APR (Annual Percentage Rate), which reflects the total cost of borrowing. Consider whether a secured or unsecured loan best suits your needs and risk tolerance.

Finally, assess your long-term financial goals. Will this loan help you achieve them? Or will the added debt hinder your progress? Could you achieve your goal through alternative methods, such as saving or delaying the purchase? Be certain the loan aligns with your overall financial plan.