Securing funding for your business venture can be a daunting task, but a well-crafted business plan is your most powerful tool. This article focuses on creating a plan that not only attracts investors but, more importantly, convinces lenders to provide the financing you need. While investors look for high-growth potential and eventual return on investment, lenders prioritize repayment capability and risk mitigation. Understanding this crucial difference is key to securing the loans necessary to launch and grow your business successfully. We’ll guide you through the essential elements, demonstrating how to tailor your plan to resonate with lenders and improve your chances of approval.

This comprehensive guide will equip you with the knowledge to construct a compelling business plan that specifically addresses a lender’s concerns. Learn how to effectively present your financial projections, demonstrating a realistic path to profitability and debt repayment. We’ll delve into the intricacies of crafting a robust financial statement and showcasing your management team’s experience and capability to navigate market challenges. Discover how to highlight collateral, cash flow, and other factors lenders heavily scrutinize. By the end of this article, you’ll have a clear understanding of how to build a business plan that secures the funding you need, paving the way for your business’s success.

Why Lenders Care About More Than Revenue

While revenue is a crucial factor for lenders, it’s not the only metric they consider. Lenders are primarily concerned with repayment ability. This means they scrutinize your business’s cash flow, profitability beyond just revenue (looking at expenses and margins), and the overall financial health of your organization.

They need to be confident you can consistently generate enough cash to cover loan repayments, even during periods of slower sales or unexpected expenses. Debt-to-equity ratio, credit history, and the strength of your business model are all key indicators of your ability to repay the loan. Essentially, lenders assess your business’s risk profile and want assurance that their investment is secure.

Furthermore, lenders evaluate collateral you can offer, which secures the loan. The value of your assets plays a vital role in their decision-making process. Your business plan needs to convincingly demonstrate not just high revenue projections, but also a sound financial strategy that mitigates risk and ensures loan repayment.

What a Loan-Ready Business Plan Should Include

A loan-ready business plan differs from one designed to attract investors. Lenders prioritize financial stability and repayment capacity above all else. Therefore, your plan must meticulously detail these aspects.

Financial Projections: Include comprehensive, realistic financial statements (profit and loss, cash flow, balance sheet) for at least three to five years. These projections should demonstrate a clear path to profitability and sufficient cash flow to cover loan repayments. Clearly articulate your assumptions and the methodology used in creating these projections.

Management Team: Lenders assess the competence and experience of the management team. Highlight the team’s relevant skills and experience, emphasizing their ability to manage the business and repay the loan. Include resumes and biographical information for key personnel.

Collateral: If using collateral to secure the loan, provide a detailed description and valuation of all assets pledged. This should include appraisals and supporting documentation.

Loan Repayment Plan: Detail a specific and realistic plan for repaying the loan, outlining the source of repayment (e.g., revenue projections, asset sales). Clearly state the loan amount requested, the proposed repayment schedule, and any contingency plans.

Industry Analysis and Market Research: While not the primary focus, a concise industry analysis demonstrating market demand and your business’s competitive advantage is essential for establishing market viability and the likelihood of repayment.

Legal Structure: Clearly state your business’s legal structure (sole proprietorship, partnership, LLC, corporation) and ensure all necessary legal documentation is in order.

Use of Funds: Specify precisely how the loan proceeds will be used. This should be tied directly to the financial projections and demonstrate a direct link between the funds and increased profitability and repayment ability.

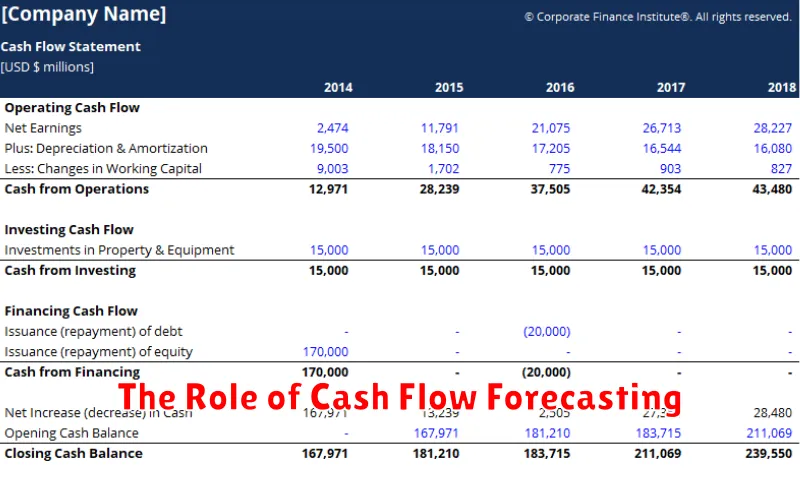

The Role of Cash Flow Forecasting

A cash flow forecast is crucial for attracting lenders because it demonstrates your understanding of your business’s financial health and its ability to repay debt. It’s more than just projecting revenue; it provides a realistic picture of your incoming and outgoing cash over a specific period, typically one to three years.

Lenders assess solvency and liquidity; a well-prepared cash flow forecast directly addresses these concerns. It highlights potential shortfalls and periods of surplus, allowing lenders to gauge your ability to meet your debt obligations. A forecast showcasing consistent positive cash flow significantly increases your chances of securing a loan.

Your forecast should incorporate realistic assumptions about sales, expenses, and financing activities. Detailing the basis for your projections—market research, sales history, etc.—adds credibility and demonstrates due diligence. Addressing potential risks and their impact on cash flow further strengthens your application, proving you’ve considered various scenarios.

In short, a robust cash flow forecast provides lenders with the confidence they need to approve your loan application. It’s a cornerstone of a strong business plan specifically tailored to attract financing from lenders.

Include a Loan Purpose Breakdown

A clear and concise loan purpose breakdown is crucial for attracting lenders. This section shouldn’t just state the amount needed; it must detail precisely how the funds will be used to benefit the business.

Instead of vague statements, itemize specific expenses. For example, instead of saying “Working capital,” specify: “Acquisition of new inventory ($X), marketing and advertising campaign ($Y), three months’ operating expenses ($Z).” This level of detail demonstrates careful planning and responsible financial management.

Furthermore, clearly articulate the expected return on investment (ROI) for each expense category. Show how each expenditure will contribute to increased revenue, reduced costs, or improved efficiency. Quantifiable metrics build lender confidence.

Remember to tie each expense directly back to the overall business goals outlined in your plan. This connection highlights the strategic importance of the loan and strengthens your application. A well-defined loan purpose breakdown showcases your preparedness and increases your chances of securing financing.

Highlight Repayment Ability and Risk Mitigation

Lenders prioritize understanding your repayment capacity. Clearly demonstrate how your business will generate sufficient cash flow to comfortably cover loan repayments. Include detailed financial projections, showing realistic revenue streams and operating expenses. A strong emphasis on profitability and a conservative approach to forecasting will instill confidence.

Addressing potential risks is crucial. Proactively identify key risks your business faces (market competition, economic downturns, supply chain disruptions, etc.) and outline your mitigation strategies. This demonstrates foresight and preparedness, minimizing lender concerns. Be transparent; acknowledging risks, while simultaneously detailing your plan to overcome them, is a sign of a well-managed business.

Highlight any collateral you can offer as security for the loan. This reduces lender risk and increases your chances of approval. Clearly state the value and type of collateral. Furthermore, showing a personal guarantee, if applicable, reinforces your commitment to the loan’s success.

A well-structured financial model is essential. Include key financial ratios such as debt-to-equity ratio, current ratio, and profitability margins. These demonstrate financial health and assist lenders in evaluating your repayment ability and risk profile accurately.

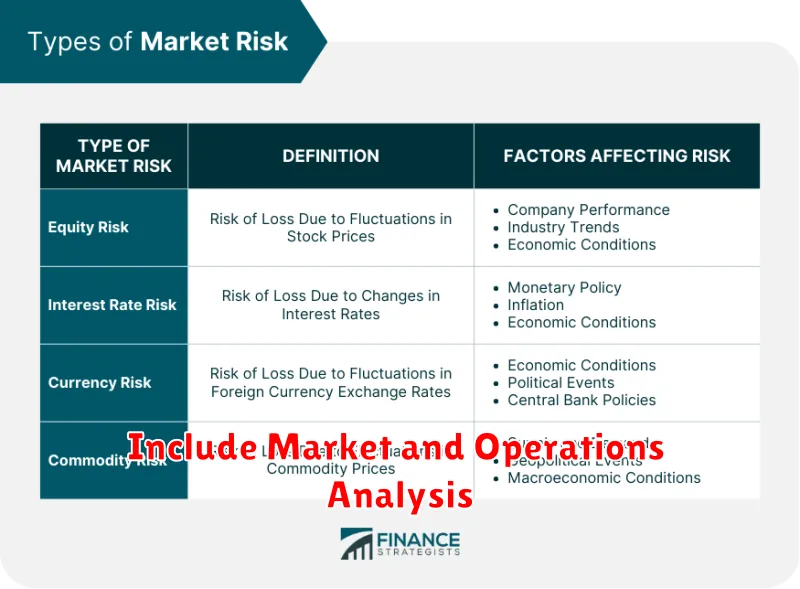

Include Market and Operations Analysis

Lenders, unlike investors, prioritize risk mitigation. A robust market and operations analysis demonstrates your understanding of the market landscape and your ability to manage operational risks effectively. This section is crucial for securing a loan.

Your market analysis should clearly define your target market, outlining its size, growth potential, and key characteristics. Include competitive analysis, highlighting your competitive advantages and strategies for market penetration. Data-driven projections of revenue and market share are essential, demonstrating realistic financial forecasts.

The operations analysis details your business processes, production methods, and management team. It should clearly explain how you will deliver your product or service efficiently and profitably. This section should address potential operational challenges and detail your mitigation strategies. Include information on your location, facilities, and equipment, demonstrating your preparedness to execute your business plan.

Detailed financial projections, integrated with both the market and operations analysis, are crucial. Lenders need to see a clear path to profitability and repayment of the loan. This involves demonstrating a strong understanding of your costs, pricing strategy, and cash flow management.

By presenting a comprehensive market and operations analysis, you showcase your preparedness and reduce lender concerns, significantly increasing your chances of loan approval.

Keep It Concise but Data-Driven

Lenders, unlike investors, prioritize financial stability and repayment capacity. Your business plan needs to reflect this. Avoid lengthy narratives; focus on clear, concise data illustrating your business’s viability.

Key financial projections like revenue forecasts, expense budgets, and cash flow statements should be prominently featured and meticulously detailed. Support these projections with realistic market analysis and clear explanations of your assumptions.

Use strong visuals, such as charts and graphs, to present complex financial data in an easily digestible format. This enhances understanding and demonstrates a professional approach to financial planning.

Emphasize key performance indicators (KPIs) relevant to repayment capacity, such as debt-to-equity ratio, current ratio, and profitability margins. Show how your business model ensures consistent cash flow to cover loan repayments.

Finally, maintain a crisp and professional tone throughout the document. Avoid jargon and focus on clear, concise language that lenders can easily understand and trust. Conciseness and data-driven arguments are crucial for securing lender approval.