Considering a student loan to finance your higher education? It’s a significant financial decision that can shape your future. Before you sign on the dotted line, it’s crucial to understand the complexities and potential implications of taking out a student loan. This article will equip you with the essential knowledge to navigate the student loan process effectively, helping you make informed decisions about student loan debt and your financial well-being.

Understanding student loan options, interest rates, repayment plans, and the long-term impact on your finances is paramount. We will cover key aspects such as comparing different student loan types, including federal student loans and private student loans, assessing your affordability, and exploring strategies for managing student loan debt after graduation. Making informed choices about student loans is crucial to avoid overwhelming debt and ensure a smoother transition into your post-graduate life. Let’s delve into the critical factors you need to consider before taking out a student loan.

Federal vs Private Student Loans Explained

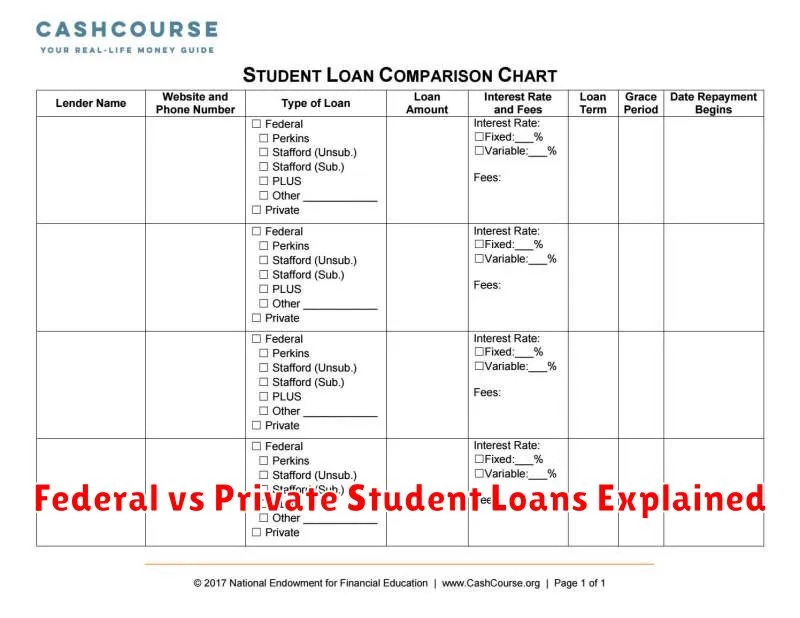

Understanding the differences between federal and private student loans is crucial before borrowing. Federal student loans are offered by the U.S. government and generally come with more favorable terms and borrower protections.

Key advantages of federal loans include fixed interest rates, income-driven repayment plans, and deferment options during periods of financial hardship. They also often offer lower interest rates than private loans. Eligibility is based on financial need and enrollment in an eligible educational program.

Private student loans, on the other hand, are offered by banks and credit unions. They typically have higher interest rates, less flexible repayment plans, and fewer borrower protections. Approval is based primarily on creditworthiness; co-signers are often required for students with limited or no credit history.

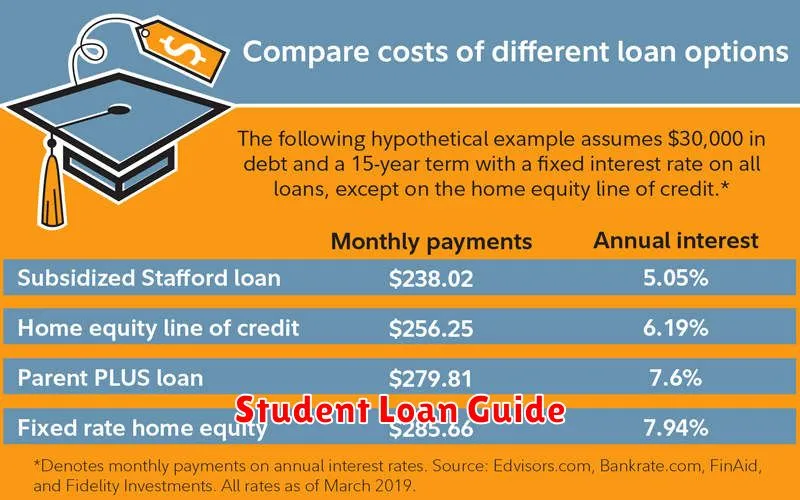

Choosing the right loan depends on individual circumstances. Federal loans should generally be exhausted first due to their benefits. Private loans might be considered only after federal loan limits have been reached or if federal loans are insufficient to cover educational expenses. Carefully compare interest rates, fees, and repayment terms before making a decision.

How Interest Works While You’re in School

Understanding how interest accrues on your student loans while you’re still in school is crucial. Most federal student loans, and many private ones, offer a grace period before repayment begins, typically after graduation or leaving school. However, interest still accrues during this period. This means that interest is added to your loan’s principal balance each day, even though you aren’t making payments.

The amount of interest that accrues depends on several factors: your loan’s interest rate (which is fixed or variable), the principal loan amount, and the length of time you’re in school. A higher interest rate will lead to faster interest accumulation.

There are two main ways interest can accrue during your studies: simple interest and capitalization. With simple interest, interest is calculated only on the principal balance. Capitalization means the accumulated interest is added to the principal balance, and future interest is calculated on this increased amount. This effectively means you’re paying interest on your interest, resulting in a larger overall debt.

Understanding capitalization is vital as it significantly impacts your total loan cost. Some loan programs allow you to make interest payments while in school, preventing capitalization. This could result in considerable savings over the life of the loan. Review your loan documents carefully to understand the terms of your particular loan and whether your interest will capitalize or be added to your principal balance.

Grace Periods and Loan Repayment Terms

Before taking out a student loan, understanding grace periods and repayment terms is crucial. A grace period is the time after you graduate or leave school before you’re required to begin making loan payments. The length of this period varies depending on the type of loan and lender, often ranging from six months to a year. It’s essential to know your specific grace period to avoid late payment fees and negative impacts on your credit score.

Loan repayment terms outline the schedule for repaying your loan. This typically includes the monthly payment amount, the total loan term (length of repayment), and the interest rate. Repayment plans can vary; some offer fixed monthly payments, while others may allow for income-driven repayment options. Carefully review these terms to understand your long-term financial obligations and choose a repayment plan that aligns with your post-graduation financial expectations.

Understanding both grace periods and repayment terms allows you to budget effectively for loan repayment and avoid potential financial hardship. Contact your lender to clarify any questions or concerns regarding your specific loan terms.

Understanding Loan Forgiveness Programs

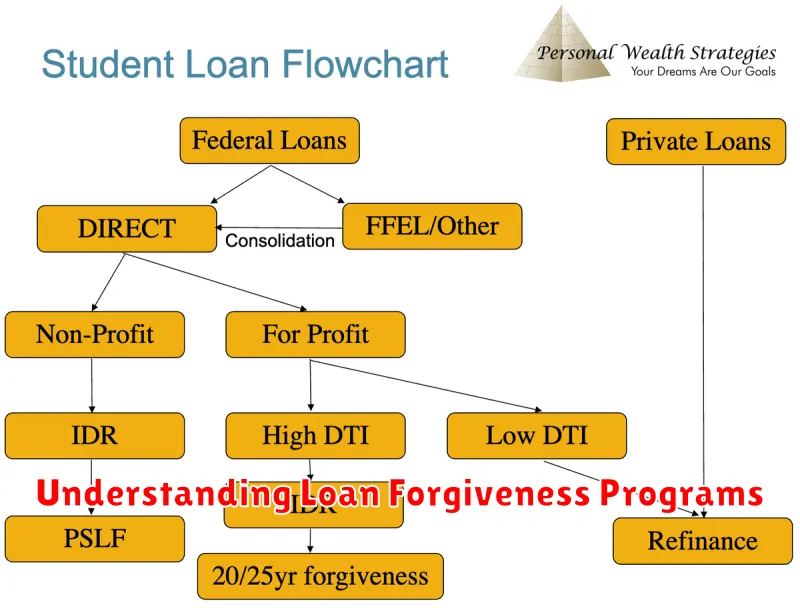

Student loan forgiveness programs offer the potential to eliminate a portion or all of your student loan debt. However, it’s crucial to understand that these programs often have strict eligibility requirements and specific criteria that must be met.

Several programs exist, including those based on public service (like working for a government agency or non-profit), income-driven repayment plans (where payments are based on your income), and programs tied to specific loan types or educational fields. Eligibility varies greatly depending on the program.

Key factors to consider include the type of loan you have, your employment history, and your income level. Many programs require years of qualifying employment or adherence to specific repayment plans before any forgiveness is granted.

It’s essential to thoroughly research the specifics of any program you’re considering. The application process can be complex and time-consuming, so starting early is recommended. Be aware that even with forgiveness, tax implications may apply to the forgiven amount.

Consult a financial advisor or student loan counselor to determine if a forgiveness program is a viable option for your individual circumstances. They can help you navigate the complexities and ensure you make informed decisions.

The Importance of Borrowing Only What You Need

Taking out a student loan is a significant financial decision that can impact your future for years to come. It’s crucial to understand that borrowing only the amount you absolutely need is paramount.

Borrowing more than necessary leads to higher monthly payments after graduation, making it more difficult to manage your finances and potentially delaying major life goals like buying a home or starting a family. The added interest accrued over time significantly increases the total cost of your education.

Before applying for a loan, carefully assess your financial resources. Explore all available scholarships, grants, and work-study opportunities to minimize the amount you need to borrow. Create a realistic budget that accounts for tuition, fees, living expenses, and other educational costs. This careful planning helps determine the precise amount you need to finance your education, avoiding unnecessary debt.

Remember, responsible borrowing means borrowing only what’s essential to achieve your educational goals. This approach ensures you graduate with manageable debt, allowing you to focus on building a secure financial future.

Repayment Plans: Income-Based vs Fixed

Choosing a student loan repayment plan is a crucial decision impacting your finances for years. Two main options exist: income-based repayment (IBR) and fixed repayment plans. Understanding their differences is vital before borrowing.

Income-based repayment (IBR) plans tie your monthly payments to your income and family size. This means lower payments during periods of lower income, potentially offering more financial flexibility. However, IBR plans typically extend the loan repayment period, leading to higher total interest paid over the life of the loan.

Fixed repayment plans involve consistent monthly payments over a set period (usually 10 years). While payments are higher, you’ll pay off your loan faster and ultimately pay less interest. This predictability can be beneficial for budgeting, but it can be challenging to maintain during periods of financial hardship.

The best option depends on your individual circumstances and financial projections. Consider your anticipated post-graduation income, your risk tolerance, and your long-term financial goals when making your decision. Careful consideration of the total interest paid over the life of the loan is essential, regardless of the plan chosen.

Resources for Tracking and Managing Loans

Effectively managing your student loans requires diligent tracking and organization. Several resources can assist you in this process.

Your lender’s website is a primary resource. Most lenders provide online portals allowing you to view your loan balance, payment history, interest rates, and upcoming payments. Utilize these portals regularly to stay informed.

Spreadsheet software, such as Microsoft Excel or Google Sheets, can be invaluable for creating a personalized loan tracking system. You can manually input loan details and track payments, interest accrual, and remaining balances for all your loans in one place.

Consider using dedicated student loan management apps. Many apps offer features like loan aggregation, payment scheduling reminders, and even the ability to make payments directly through the app. Research and compare available apps to find one that suits your needs.

Finally, don’t underestimate the value of printed records. Keep physical copies of your loan documents, payment confirmations, and any correspondence with your lender. This provides a backup in case of online access issues.

By utilizing a combination of these resources, you can maintain a clear and organized overview of your student loan situation, empowering you to manage your debt effectively.