Navigating the complex world of student loans can be daunting, especially for students facing the monumental task of financing their higher education. This article serves as a comprehensive guide to understanding the intricacies of student loan debt, empowering you to make informed decisions that minimize financial strain during and after your academic journey. We will explore various types of student loans, including federal loans and private loans, helping you decipher the nuances of interest rates, repayment plans, and the potential impact on your future credit score. Understanding your loan options is the first crucial step in responsible borrowing.

More than just numbers and paperwork, student loans represent a significant investment in your future. This guide aims to demystify the process, providing essential information on topics such as loan forgiveness programs, deferment and forbearance options, and effective debt management strategies. Whether you’re a prospective student planning your financial aid strategy or an existing borrower seeking to optimize your repayment plan, we will provide practical advice and actionable insights to help you effectively manage your student loan debt and achieve long-term financial stability. Learn how to avoid the pitfalls of student loan debt and pave the way for a financially secure future.

Difference Between Federal and Private Student Loans

Federal student loans are offered by the U.S. government through various programs. They generally offer more borrower protections, such as income-driven repayment plans and loan forgiveness programs. Interest rates are typically lower than private loans, and eligibility is based on financial need and enrollment status.

Private student loans, on the other hand, come from banks, credit unions, and other private lenders. They often have higher interest rates and fewer borrower protections compared to federal loans. Eligibility is determined by creditworthiness (often requiring a co-signer for students with limited credit history) and the loan amount may be influenced by credit score and other financial factors.

Key Differences Summarized:

- Lender: Federal loans are from the government; private loans are from private lenders.

- Interest Rates: Federal loans typically have lower interest rates.

- Borrower Protections: Federal loans offer more borrower protections, such as income-driven repayment plans and loan forgiveness programs.

- Eligibility: Federal loans are based on financial need and enrollment; private loans are based on creditworthiness.

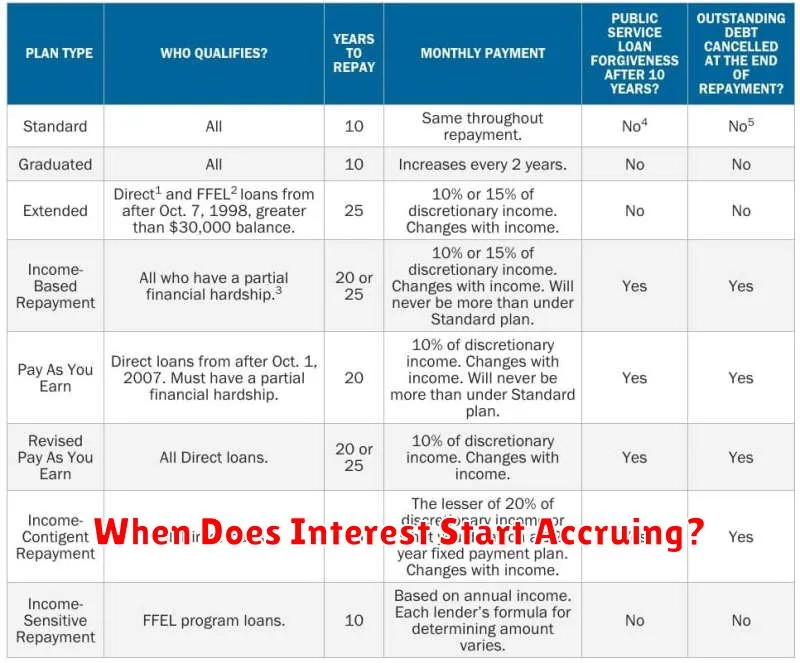

When Does Interest Start Accruing?

Understanding when interest starts accruing on your student loans is crucial for managing your debt. For most federal student loans, interest begins accruing immediately after the disbursement of the loan funds, unless you are eligible for a grace period. This grace period typically offers a period of time, usually six months after graduation, before interest starts to accumulate. However, it’s important to note that this grace period applies to subsidized federal loans only. For unsubsidized federal loans and private student loans, interest accrues from the moment the loan is disbursed, even while you’re still in school.

Therefore, the timing of interest accrual differs significantly depending on the type of loan. Carefully review your loan documents to determine the specific start date for interest accumulation on each of your loans. Failing to understand this can lead to significantly higher total loan repayment costs over the life of the loan.

In short: Be aware of your loan types (federal subsidized, federal unsubsidized, private) to understand when interest starts accruing. Understanding this is a key step in effective student loan management.

How Grace Periods and Repayment Plans Work

After graduation or leaving school, most federal student loans enter a grace period. This is a period of time, typically six months, where you are not required to make payments. It gives you time to find a job and adjust to your post-school life.

Once the grace period ends, repayment begins. You’ll need to choose a repayment plan. Several options exist, each with different terms and monthly payments. Standard repayment involves fixed monthly payments over 10 years. Extended repayment spreads payments over a longer period (up to 25 years), resulting in lower monthly payments but higher total interest paid. Graduated repayment starts with lower monthly payments that gradually increase over time. Income-driven repayment (IDR) plans base your monthly payment on your income and family size. IDR plans often lead to loan forgiveness after 20 or 25 years, depending on the specific plan.

It’s crucial to understand the implications of each plan before choosing one. Consider factors like your income, expenses, and long-term financial goals. Contact your loan servicer to discuss your options and determine the best repayment plan for your circumstances. Failing to make payments can lead to negative consequences such as damage to your credit score and potential collection actions.

Understanding Loan Forgiveness Programs

Student loan forgiveness programs offer the potential to eliminate some or all of your student loan debt under specific circumstances. These programs are designed to incentivize borrowers to pursue careers in public service or demonstrate significant financial hardship.

Eligibility requirements vary widely depending on the specific program. Factors such as the type of loan, your career field, income level, and loan servicer will all play a role in determining eligibility. Some programs require a set number of years of qualifying employment, while others consider factors like total loan balance and income-driven repayment plan participation.

Public Service Loan Forgiveness (PSLF), for example, is one such program, forgiving the remaining balance of federal loans for borrowers employed full-time by a government or non-profit organization for ten years while making 120 qualifying monthly payments under an income-driven repayment plan. Teacher Loan Forgiveness is another option, offering forgiveness for eligible teachers who meet specific service requirements.

It is crucial to thoroughly research and understand the eligibility requirements of any loan forgiveness program you are considering. Contact your loan servicer and explore the official government websites for detailed information and application processes. Remember that forgiveness programs are complex and requirements can change, so staying informed is key.

Long-Term Impact on Career and Lifestyle

Student loan debt can significantly influence your long-term career and lifestyle choices. The weight of repayment can affect your ability to pursue certain career paths, potentially limiting options to higher-paying jobs to accelerate debt reduction. This may involve sacrificing personal preferences for job satisfaction in favor of financial stability.

Financial constraints from loan repayments can also impact lifestyle choices. Large monthly payments can restrict spending on housing, transportation, and other essential needs, limiting opportunities for leisure activities, travel, and saving for major life events such as buying a home or starting a family. Careful planning and budgeting are crucial to managing this impact effectively.

Career flexibility may also be compromised. The fear of jeopardizing repayment plans can make it difficult to pursue opportunities like further education, entrepreneurship, or career changes that may involve temporary income reductions. Understanding the potential long-term ramifications is vital in making informed career decisions.

Ultimately, navigating the long-term effects of student loan debt requires careful consideration of career aspirations, financial planning, and lifestyle expectations. Proactive budgeting, exploring various repayment options, and seeking financial advice can help mitigate the potential negative impacts and enable a more fulfilling future.

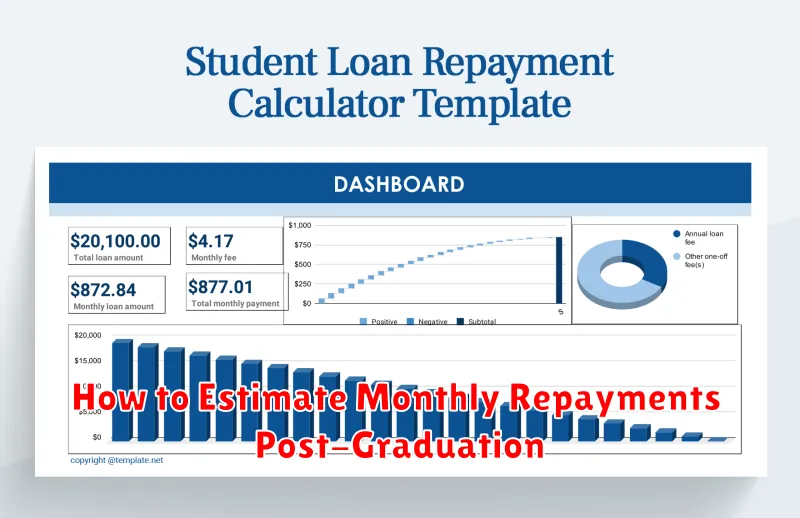

How to Estimate Monthly Repayments Post-Graduation

Estimating your monthly student loan repayments after graduation is crucial for effective financial planning. Several factors influence this amount, most importantly the loan principal (the original amount borrowed), the interest rate, and the loan repayment term (the length of time you have to repay the loan).

A simple way to get a preliminary estimate is using an online student loan repayment calculator. Many reputable websites and financial institutions offer these free tools. You’ll typically need to input your loan amount, interest rate, and desired repayment period. The calculator will then provide an estimated monthly payment.

It’s important to remember that these are just estimates. Your actual monthly payment may vary slightly depending on the lender and specific loan terms. Always check your official loan documents for the final payment amount. Furthermore, consider the potential impact of deferment or forbearance options, which can temporarily postpone payments but typically accrue additional interest.

Beyond online calculators, you can also contact your loan servicer directly. They are responsible for collecting your loan payments and can provide you with a personalized repayment schedule and detailed information about your loan terms.

Tips for Avoiding Excessive Borrowing

Before taking out any student loans, meticulously research the cost of your chosen college or university. Compare tuition fees, living expenses, and other associated costs across different institutions to identify more affordable options.

Explore all available financial aid options. This includes grants, scholarships, and work-study programs, which can significantly reduce your reliance on loans. Many institutions have dedicated financial aid offices to assist in this process.

Prioritize budgeting and saving. Create a realistic budget that outlines your expected expenses throughout your education. Even small amounts saved consistently can reduce the amount you need to borrow.

Consider attending a community college for your first two years. This can drastically lower your overall tuition costs, allowing you to transfer to a four-year university with a reduced debt burden. Community colleges often offer more affordable tuition rates.

Carefully evaluate your career goals. Choose a major that aligns with your interests and potential earning power. A higher-paying career can facilitate faster loan repayment.

Borrow only what is absolutely necessary. Avoid borrowing more than the estimated cost of your education, and always prioritize grants and scholarships before resorting to loans.